1. Changelog

| Version | Date | Description |

|---|---|---|

14.2 |

2026-03-04 |

A new response code |

14.1 |

2026-02-11 |

Diagram changes in Payouts to Account section and validate method removed |

14.0 |

2026-02-12 |

Added a new account status: DELETED – see details here |

13.9 |

2026-02-10 |

Added new response code |

13.8 |

2026-01-26 |

First name and last name regular expression was changed in every API method. The ability to send special characters and emoticons has been blocked. To check the expression, visit chapter with API method that you use. |

13.7 |

2026-01-26 |

Get transaction details method is removed from API |

13.6 |

2026-01-06 |

Changes in mail sending chapter |

13.5 |

2026-01-05 |

Transaction model of Card to Deposit is not supported and removed from documentation. |

13.4 |

2025-12-20 |

Change of status effective from 2026-02-01. From From From |

13.3 |

2025-12-06 |

End of delayed payment support |

13.2 |

2025-11-27 |

We will no longer support the use of API-TOKEN in the request header. |

13.1 |

2025-11-25 |

Updated documentation for Payout-on-accounts, Daily and Monthly reports description added here: 13.1.3. Payouts on Account transaction model |

13.0 |

2025-11-21 |

Changed the way Global Delayed Receivers are retrieved and deleted. |

12.91 |

2025-10-29 |

Updated documentation for Payout-on-accounts, added SEPA corridors and reorganized description for non-SEPA corridors. |

12.9 |

2025-10-27 |

Changes in 3. Send money. New validations on houseNumber. This is optional for transactions below 15,000 EUR. |

12.8 |

2025-10-14 |

Changes in Models. |

12.7 |

2025-10-05 |

Added documentation for daily and monthly transaction reports. Go to Reports chapter for more details |

12.6 |

2025-09-20 |

Extension of the authorization 3DS API method with optional fields for increase positive response 3DS Authentication |

12.5 |

2025-09-19 |

The requirement for the |

12.4 |

2025-09-15 |

Added new api statuse: |

12.3 |

2025-08-25 |

The restriction preventing the same card from being added as a friend card for multiple users has been removed.

Previously, attempting to add a friend card that was already assigned to another user resulted in a |

12.2 |

2025-08-13 |

Added new status to check status 3.7 Payouts to Account response: |

12.1 |

2025-07-28 |

Added new field 'cryptoTransactionIndicator' in Send Money request 3. Send money. The field apply only to Visa transactions. Acceptable values: 2.12. Additional crypto transaction indicators |

12.0 |

2025-06-11 |

Starting from September 2025, we will no longer support the use of API-TOKEN in the request header. Instead, please switch to the method described in the PLAIN-DATACORE, DATACORE-DATACORE, DATACORE-PLAIN tabs. |

11.9 |

2025-06-27 |

Introduced |

11.8 |

2025-06-27 |

Added new required field when adding and editing user - language. More here: User management |

11.7 |

2025-06-06 |

Added new webhook notification occurring during change of datacenter user status 4.3. Datacenter user status |

11.6 |

2025-06-02 |

Added support for userId-based sender requests. In addition to providing full sender data in the request body, it is now possible to send requests using only the userId of a previously added user via User management methods |

11.5 |

2025-05-30 |

Effective 01.07.2025 the sender.birthDate field will be required for all Senders where transactions involving a Visa card. Senders |

11.4 |

2025-05-20 |

New user account statuses and their handling in the system have been added. Some activities will be limited by the account status. More here: User account statuses |

11.3 |

2025-05-09 |

Added new status to check status 3.7 Payouts to Account response: |

11.2 |

2025-05-05 |

Added new api statuses: |

11.1 |

2025-04-25 |

Added new api statuses: |

10.32 |

2025-04-01 |

New transaction model - Card to Deposit launched and documentation moved to new section - [3.8 Card to Deposit] |

10.31 |

2025-04-30 |

Changes the field requirements in sender objects for BLIK (Sender Blik) email adress and add new sender IDs for Payout (Sender Cash) transactions: senderAccountNumber, senderAccountType 13. Models. |

10.30 |

2025-03-31 |

Changes in 10. Datacenter - A new API for global delayed receivers has been introduced. Detailed documentation for the new API is available here. |

10.29 |

2025-03-26 |

Changes in 10. Datacenter - A new API for friendly receiver cards has been introduced. Detailed documentation for the new API is available here. |

10.28 |

2025-03-24 |

Added new field 'purposeCodeOfTransaction' in Send Money request 3. Send money. The field apply only to Mastercard transactions. Acceptable values: 2.12. Purpose codes of transaction |

10.27 |

2025-03-21 |

Changes in 10. Datacenter - A new API for card management has been introduced. Detailed documentation for the new API is available here. |

10.26 |

2025-03-10 |

Changes in the structure of the documentation and change the API of Datacenter methods. |

10.25 |

2025-03-07 |

Extension of methods currency for card by business card |

10.24 |

2025-02-25 |

Changes in 3. Send money - Added optional additional merchant commission to request for PLAIN_PLAIN and BLIK_PLAIN passed by field additionalMerchantCommission. Changes in 9. Calculate commission Added optional additional merchant commission to request passed by field additionalMerchantCommission. Changes take effect from 2025-03-03. |

10.23 |

2025-02-15 |

Changes in 3. Send money - added new optional field additionalData.note. More details about this field may be found in send money request fields description. |

10.22 |

2025-02-12 |

Changes in 3. Send money - API updates for transactions from high-risk third countries. For such transactions, we require transactionReason. A new status has been introduced to the send-money response: ERROR_TRANSACTION_REASON_IS_REQUIRED. Transactions from high-risk third countries without a transaction reason will be rejected with this status. The determination of whether a transaction originates from a high-risk third country is based on the issuing country of the card or the country of the bank account used for the transaction. The changes will take effect from 2025-04-01 |

10.21 |

2025-02-11 |

Added validation for cards on preAuthentication request with new status codes 5.4 Status codes for 3DS 2.X verification methods. Examples: 422 UNPROCESSABLE ENTITY Card errors. Changes take effect from 2025-03-03. |

10.20 |

2025-01-30 |

Changes in 3. Send money - api updates for body of sender and receiver in response for check status and check detailed status. Changes take effect from 03.03.2025. |

10.19 |

2025-01-21 |

Enable sending of 'sender.paymentData.eciIndicator' field value 07 if transaction is processed after 3ds authorization |

10.18 |

2025-01-14 |

New validations on firstName, lastName and address data(street, houseNumber, city, postalCode, flatNumber) from 2025-03-03. |

10.17 |

2025-01-10 |

Added new status to check status send-money response: BUSINESS_CARD_NOT_SUPPORTED |

10.16 |

2024-12-19 |

3.7.4. Calculate commission for payout to account New method introduced to calculate commission for payouts to accounts |

10.15 |

2024-12-17 |

Changes in 3. Send money - API updates for transactions above 15,000 EUR. For such transactions, mandatory address information for both sender and receiver is now required: city, postalCode, street, houseNumber and country. A new status has been introduced to the send-money response: ERROR_MISSING_COMPLETE_ADDRESS_FOR_TRANSACTION_ABOVE_AMOUNT_THRESHOLD. Transactions above 15,000 EUR that are missing the required address information will be rejected with this status. Changes take effect from 2025-02-01 |

10.14 |

2024-12-11 |

Added new status to check status send-money response: ERROR_TOO_MANY_DECLINED_TRANSACTIONS_FOR_THE_CARD |

10.13 |

2024-12-06 |

Changes in 3. Send money - API changes to comply with the requirements set by the VISA card organization, the following changes are being implemented for the send-money functionality, specifically when the recipient is a holder of a Canadian payment card: mandatory address information: country, province, city, postalCode, street, houseNumber. Transactions that do not meet the address presence requirements will be rejected. |

10.12 |

2024-10-31 |

Changes in 3.7 Payouts to Account - changes in recipient Currency. Update in Korea B2P corridor. Removed sender.governmentId, source of income. |

10.11 |

2024-10-23 |

Changes in 3.7 Payouts to Account request body fixed, governmentId type change from string to object. |

10.10 |

2024-10-16 |

Added validation for the methodNotificationUrl field in the /client/3ds/preAuthentication method |

10.9 |

2024-10-15 |

New status ERROR_DOMESTIC_TRANSACTION_NOT_PERMITTED_FOR_CARD - for some bin transaction with merchant country code and issuer country code is same is not permitted. New response code CODE_4F. |

10.8 |

2024-10-14 |

Changes in 3.7 Payouts to Account transaction model - new Corridors introduced |

10.7 |

2024-10-01 |

Changes in 3.6 Card to Account and 3.7 Payouts to Account transaction model - Corridors concept and their validation introduced |

10.6 |

2024-09-30 |

Added support for JWE data encryption. More details can be found in JWE Encryption chapter |

10.5 |

2024-09-29 |

Added support for encrypted tokens is send money requests. Check 3DS Pre Authentication 3DS Authentication, Card 2 card methods for examples and more details. |

10.4 |

2024-09-02 |

Added new tab 3.6 Card to Account for CARD_ACCOUNT transaction and tab 3.7 Payouts to Account for CASH_ACCOUNT transaction |

10.3 |

2024-08-29 |

Mock for Mastercard and Visa test cards have been added only for Staging env 2.7. Mock cards for test. |

10.2 |

2024-08-06 |

Change validation for firstName, lastName and cardholderName. Fields cannot start and end with whitespace characters. Full regular expressions may be found in every sendmoney request (e.g. Card 2 card) and 3DS Authentication requests. Requirements will apply from 2024-10-01 in production environment. |

10.1 |

2024-08-01 |

Change validation for 7.2. Authentication method. From August 12th Visa will officially require to provide one of these fields: cardholderEmail, cardholderMobilePhone, cardholderHomePhone or cardholderWorkPhone. Failure to provide this value may result in 3DS authentication rejections. As of September 2 Fenige will require to provide one of these values in every Authentication request for VISA. |

10.0 |

2024-07-20 |

Added tokenize card support in all send-money methods |

9.9 |

2024-07-01 |

New fields 'subMerchantName' and 'subMerchantCountry' in Send Money request added. Both fields are conditional - mandatory only when merchant is configured as marketplace. |

9.8 |

2024-06-25 |

A new field has been added - 'sendMoneyType' in response to request 3.1.6. Transaction details and 3.2.6. Transaction details. |

9.7 |

2024-05-23 |

Added optional "rodo" and "marketing" flags for Add user USA or CAN transactions request 11.1.1. Add user, and Update user request 11.2.1. Update user |

9.6 |

2024-04-16 |

Added new webhook notification occuring during CASH_ACCOUNT transaction processing. |

9.5 |

2024-04-10 |

Added webhook : Acquirer reconciliation date webhook + Acquirer reconciliation date webhook |

9.4 |

2024-04-06 |

New transaction model in Payouts area is released. Now we can process transaction from Card to Account number. New transaction model was added as new tab in Card to Card section: + New CARD-ACCOUNT transaction model + New CARD-ACCOUNT transaction model with 3DS |

9.3 |

2024-04-05 |

New regexp for houseNumber |

9.2 |

2024-04-05 |

Payouts to Card Possibility to make payouts with tokens. |

9.1 |

2024-02-15 |

Release of the new method Calculate commission payout. The method informs about the amount that will be removed from the deposit and gives possibility to use exact result in the send money method. |

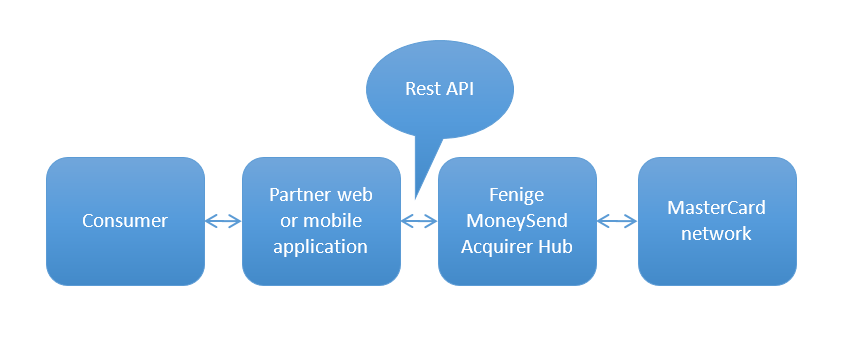

2. Introduction

The document describes the technical scope of the "Fenige Transfer HUB REST API", i.e. services provided by a financial institution acting as an Acquirer and Processor, enabling money transfers to and from cards, bank accounts, and alternative payment methods (e.g. BLIK).

Quick tutorial that may helps you in works with API you can find here: Tutorial

Documentation has been prepared for external partners that are willing to cooperate with Fenige and offer MoneySend and Visa Direct money transfers within their mobile or web applications. The roles of Fenige and Partner in such project are the following:

Partner:

Fenige:

High Level Architecture:

Transaction process:

2.1. Endpoints

| Environment | Endpoint (base url) |

|---|---|

Staging |

2.2. HTTP verbs

RESTful notes tries to adhere as closely as possible to standard HTTP and REST conventions in its use of HTTP verbs.

| Verb | Usage |

|---|---|

|

Used to retrieve a resource |

|

Used to create a new resource |

|

Used to update specific resource |

|

Used to delete a resource |

2.3. Language

To set the language context of the request, add Accept-Language header to request. Supported languages are PL and EN. In case of a successful transaction for the send money method you will receive a email confirmation in the language which you set.

Accept-Language |

en |

2.4. General methods

All api methods require the delivery of appropriate headers.

List of methods headers used in Fenige REST API:

| Key | Value | Validation | Description |

|---|---|---|---|

|

application/json |

Required |

Used to indicate the media type of the resource |

|

application/vnd.sendmoney.v2+json |

Optional |

Used for send-money with multi-currency purpose |

|

application/vnd.sendmoney3ds.v2+json |

Optional |

Used for send-money-3ds with multi-currency purpose |

|

application/vnd.determine-currencies.v2+json |

Optional |

Used for determine currencies with multi-currency purpose |

|

application/vnd.calculate-commission.v2+json |

Optional |

Used for calculate commission with multi-currency purpose |

|

Basic dGVzdDp0ZXN0 |

Required |

Used to resolve merchant context of user. Basic Auth from merchant data (merchant name and password). Consist of keyword Basic and string obtained from Base64 coding method for merchant name and password parameter |

|

2040dc9b-28dc-4e6e-9124-f4f82c7ad997 |

Optional |

Some operations require the user context to be provided. X-USER-ID is a UUID representing the user and is returned during the user creation process. For methods that require it, this header must be included to reference the specific user. |

2.5. HTTP status codes

RESTful notes tries to adhere as closely as possible to standard HTTP and REST conventions in its use of HTTP status codes.

| Status code | Usage |

|---|---|

|

The request completed successfully |

|

The request has been accepted for processing, but the processing has not been completed. The request might or might not eventually be acted upon, as it might be disallowed when processing actually takes place |

|

The request was malformed. The response body will include an error providing further information |

|

The requested resource did not exist |

|

Message occur when an unexpected condition was encountered |

2.6. Mock cards for test

Here are test cards with a defined ResponseCode running only on the STAGING environment. Please note that these are just card ranges, you need to generate a valid card number that will be included in this card range (e.g. using any online generator that generates cards based on bin - first 6 digits).

| Begin | End | RC | MAC | Card Country | Currency |

|---|---|---|---|---|---|

5117960000000000 |

5117962249999999 |

CODE_00 |

x |

PL |

PLN |

5117962250000000 |

5117964499999999 |

CODE_00 |

x |

DE |

EUR |

5117964500000000 |

5117966749999999 |

CODE_00 |

x |

US |

USD |

5117966750000000 |

5117968999999999 |

CODE_00 |

x |

GB |

GBP |

5486000000000000 |

5486009999999999 |

CODE_05 |

x |

PL |

PLN |

5402060000000000 |

5402069999999999 |

CODE_30 |

x |

PL |

PLN |

5406603500000000 |

5406603599999999 |

CODE_05 |

03 |

PL |

PLN |

5167680100000000 |

5167680199999999 |

CODE_63 |

x |

PL |

PLN |

5296730000000000 |

5296730999999999 |

CODE_65 |

x |

PL |

PLN |

5238140000000000 |

5238140999999999 |

CODE_1A |

x |

PL |

PLN |

| Begin | End | RC | Card Country | Currency |

|---|---|---|---|---|

4400430000000000 |

4400430099999999 |

CODE_00 |

PL |

PLN |

4400430100000000 |

4400430199999999 |

CODE_00 |

DE |

EUR |

4400430200000000 |

4400430299999999 |

CODE_00 |

US |

USD |

4400430300000000 |

4400430349999999 |

CODE_00 |

GB |

GBP |

4400430350000000 |

4400430399999999 |

CODE_00 |

UA |

UAH |

4444184330000000 |

4444184339999999 |

CODE_05 |

PL |

PLN |

4444184320000000 |

4444184329999999 |

CODE_30 |

PL |

PLN |

4444184310000000 |

4444184319999999 |

CODE_N7 |

PL |

PLN |

4539120000000000 |

4539120999999999 |

CODE_65 |

PL |

PLN |

4567810000000000 |

4567810999999999 |

CODE_1A |

PL |

PLN |

2.7. Merchant advice codes

Merchant Advice Codes (MACs) are introduced by Mastercard to clearly communicate to merchants the reason for declining transactions, and the course of action that merchants can take. Occurs only for declined transactions if Mastercard returns this information.

| Merchant Advice Code | Merchant Advice Code Text |

|---|---|

|

New account information available |

|

Cannot approve at this time, try again later |

|

Do not try again |

|

Token not supported |

|

Stop recurring payment |

|

Retry after 1 hour |

|

Retry after 24 hours |

|

Retry after 2 days |

|

Retry after 4 days |

|

Retry after 6 days |

|

Retry after 8 days |

|

Retry after 10 days |

|

Consumer non-reloadable prepaid card |

|

Consumer single-use virtual card number |

2.8. Mastercard/VISA response code (ISO 8583)

Statuses in accordance with ISO-8583.

| Response Code | Reason | Authorization Status |

|---|---|---|

CODE_00 |

Approved or completed successfully |

APPROVE |

CODE_01 |

Refer to card issuer |

DECLINE |

CODE_02 |

Refer to card issuer’s special conditions |

DECLINE |

CODE_03 |

Invalid merchant or service provider |

DECLINE |

CODE_04 |

Pick up card (no fraud) |

DECLINE |

CODE_05 |

Do not honor |

DECLINE |

CODE_06 |

General error |

DECLINE |

CODE_07 |

Pick up card, special condition (fraud account) |

DECLINE |

CODE_08 |

Honor with ID |

DECLINE |

CODE_09 |

Request in progress |

DECLINE |

CODE_10 |

Approved for partial amount |

APPROVE |

CODE_11 |

Approved (V.I.P) |

DECLINE |

CODE_12 |

Invalid transaction |

DECLINE |

CODE_13 |

Invalid amount |

DECLINE |

CODE_14 |

Invalid account number (no such number) |

DECLINE |

CODE_15 |

Invalid issuer/No such issuer (first 8 digits of account number do not relate to an issuing identifier) |

DECLINE |

CODE_16 |

Approved, update track 3 |

DECLINE |

CODE_17 |

Customer cancellation |

DECLINE |

CODE_18 |

Customer dispute |

DECLINE |

CODE_19 |

Re-enter transaction |

DECLINE |

CODE_20 |

Invalid response |

DECLINE |

CODE_21 |

No action taken |

DECLINE |

CODE_22 |

Suspected malfunction |

DECLINE |

CODE_23 |

Unacceptable transaction fee |

DECLINE |

CODE_24 |

File update not supported by receiver |

DECLINE |

CODE_25 |

Unable to locate record in file |

DECLINE |

CODE_26 |

Duplicate file update record, old record replaced |

DECLINE |

CODE_27 |

File update field edit error |

DECLINE |

CODE_28 |

File temporarily not available for update or inquiry |

DECLINE |

CODE_30 |

Format error |

DECLINE |

CODE_31 |

Bank not supported by switch |

DECLINE |

CODE_32 |

Completed partially |

DECLINE |

CODE_33 |

Expired card |

DECLINE |

CODE_34 |

Suspected fraud |

DECLINE |

CODE_35 |

Card acceptor contact acquirer |

DECLINE |

CODE_36 |

Restricted card |

DECLINE |

CODE_37 |

Card acceptor call acquirer security |

DECLINE |

CODE_38 |

Allowable PIN tries exceeded |

DECLINE |

CODE_39 |

No credit account |

DECLINE |

CODE_40 |

Requested function not supported |

DECLINE |

CODE_41 |

Lost card, pick up (fraud account) |

DECLINE |

CODE_42 |

No universal account |

DECLINE |

CODE_43 |

Stolen card, pick up (fraud account) |

DECLINE |

CODE_44 |

No investment account |

DECLINE |

CODE_46 |

Closed account |

DECLINE |

CODE_51 |

Not sufficient funds |

DECLINE |

CODE_52 |

No checking account |

DECLINE |

CODE_53 |

No savings account |

DECLINE |

CODE_54 |

Expired card or expiration date is missing |

DECLINE |

CODE_55 |

Incorrect PIN or PIN missing |

DECLINE |

CODE_56 |

No card record |

DECLINE |

CODE_57 |

Transaction not permitted to cardholder |

DECLINE |

CODE_58 |

Transaction not permitted to acquirer/terminal |

DECLINE |

CODE_59 |

Suspected fraud |

DECLINE |

CODE_60 |

Card acceptor contact acquirer |

DECLINE |

CODE_61 |

Exceeds withdrawal amount limit |

DECLINE |

CODE_62 |

Restricted card (card invalid in this region or country) |

DECLINE |

CODE_63 |

Security violation (source is not correct issuer) |

DECLINE |

CODE_64 |

Original amount incorrect/Transaction does not fulfill AML requirement |

DECLINE |

CODE_65 |

Exceeds withdrawal frequency limit |

DECLINE |

CODE_66 |

Card acceptor call acquirer’s security department |

DECLINE |

CODE_67 |

Hard capture (requires that card be picked up at ATM) |

DECLINE |

CODE_68 |

Response received too late |

DECLINE |

CODE_70 |

Contact Card Issuer/PIN data required |

DECLINE |

CODE_71 |

PIN Not Changed |

DECLINE |

CODE_72 |

Account Not Yet Activated |

DECLINE |

CODE_74 |

Different value than that used for PIN encryption errors |

DECLINE |

CODE_75 |

Allowable number of PIN tries exceeded |

DECLINE |

CODE_76 |

Invalid/nonexistent “To Account” specified/Unsolicited reversal |

DECLINE |

CODE_77 |

Invalid/nonexistent “From Account” specified |

DECLINE |

CODE_78 |

Invalid/nonexistent account specified (general)/“Blocked, first used”—Transaction from new cardholder, and card not properly unblocked |

DECLINE |

CODE_79 |

Life cycle/Already reversed (by Switch) |

DECLINE |

CODE_80 |

System not available/No financial impact |

DECLINE |

CODE_81 |

Domestic Debit Transaction Not Allowed (Regional use only)/Cryptographic error found in PIN |

DECLINE |

CODE_82 |

Policy/Negative CAM, dCVV, iCVV, or CVV results |

DECLINE |

CODE_83 |

Fraud/Security (Mastercard use only |

DECLINE |

CODE_84 |

Invalid Authorization Life Cycle |

DECLINE |

CODE_85 |

Not declined/No reason to decline a request for address verification, CVV2 verification, or a credit voucher or merchandise return |

APPROVE |

CODE_86 |

PIN Validation not possible |

DECLINE |

CODE_87 |

Purchase Amount Only, No Cash Back Allowed |

DECLINE |

CODE_88 |

Cryptographic failure |

DECLINE |

CODE_89 |

Unacceptable PIN—Transaction Declined—Retry/Ineligible to receive financial position information (GIV) |

DECLINE |

CODE_90 |

Cutoff is in process (switch ending a day’s business and starting the next. Transaction can be sent again in a few minutes) |

DECLINE |

CODE_91 |

Issuer or switch is inoperative/Issuer or switch inoperative and STIP not applicable or not available for this transaction; Time-out when no stand-in; POS Check Service: Destination unavailable; Credit Voucher and Merchandise Return Authorizations: V.I.P. sent the transaction to the issuer, but the issuer was unavailable. |

DECLINE |

CODE_92 |

Financial institution or intermediate network facility cannot be found for routing |

DECLINE |

CODE_93 |

Transaction cannot be completed. Violation of law |

DECLINE |

CODE_94 |

Duplicate transmission |

DECLINE |

CODE_95 |

Reconcile error |

DECLINE |

CODE_96 |

System malfunction or certain field error conditions |

DECLINE |

CODE_A1 |

Additional customer authentication required |

DECLINE |

CODE_B1 |

Surcharge amount not permitted on Visa cards (U.S. acquirers only) |

DECLINE |

CODE_B2 |

Surcharge amount not supported by debit network issuer. |

DECLINE |

CODE_N0 |

Force STIP |

DECLINE |

CODE_N3 |

Cash service not available |

DECLINE |

CODE_N4 |

Cashback request exceeds issuer limit or appoved limit |

DECLINE |

CODE_N5 |

Ineligible for resubmission |

DECLINE |

CODE_N7 |

Decline for CVV2 failure |

DECLINE |

CODE_N8 |

Transaction amount exceeds preauthorized approval amount |

DECLINE |

CODE_P2 |

Invalid biller information |

DECLINE |

CODE_P5 |

PIN Change/Unblock request DECLINE |

DECLINE |

CODE_P6 |

Denied PIN change—requested PIN unsafe |

DECLINE |

CODE_Q1 |

Card Authentication failed |

DECLINE |

CODE_R0 |

Stop payment order |

DECLINE |

CODE_R1 |

Revocation of authorization order |

DECLINE |

CODE_R2 |

Transaction does not qualify for Visa PIN |

DECLINE |

CODE_R3 |

Revocation of all authorizations order |

DECLINE |

CODE_XA |

Forward to issuer |

DECLINE |

CODE_XD |

Forward to issuer |

DECLINE |

CODE_Z3 |

Unable to go online |

DECLINE |

CODE_TBA |

Customer ID verification failed |

DECLINE |

CODE_1A |

Additional customer authentication required (Europe Region only) |

DECLINE |

CODE_6P |

Verification Failed (Cardholder Identification does not match issuer records) |

DECLINE |

CODE_4F |

Merchant country is same as issuer country for a card range defined as cross-border only |

DECLINE |

CODE_5C |

Transaction not supported/blocked by issuer |

DECLINE |

CODE_9G |

Blocked by cardholder/contact cardholder |

DECLINE |

2.9. Response codes

RESTful notes tries to adhere as closely as possible to standard HTTP and REST conventions in its use of HTTP status codes.

| Code | Messages | Http code | Http status |

|---|---|---|---|

S0000 |

SUCCESS |

200 |

OK |

S0001 |

SUCCESS |

204 |

No Content |

S0002 |

Success transaction |

200 |

OK |

S0003 |

Transaction declined, check response code for reason |

200 |

OK |

S0004 |

PENDING |

202 |

Accepted |

S0005 |

Success reverse transaction |

200 |

OK |

S0006 |

Reverse transaction declined, check response code for reason |

200 |

OK |

S0008 |

Transaction declined. |

200 |

OK |

S0010 |

SUCCESS |

200 |

OK |

S0011 |

Refund declined |

200 |

OK |

E0111 |

Invalid format JSON |

422 |

Unprocessable Entity |

E0112 |

User not exists. |

404 |

Not Found |

E0113 |

User is blocked. |

422 |

Unprocessable Entity |

E0114 |

User is not verified. |

422 |

Unprocessable Entity |

E0115 |

Cannot unblock user. User is already blocked by Fenige. |

422 |

Unprocessable Entity |

E0122 |

Merchant not exists. |

404 |

Not Found |

E0128 |

Sub merchant does not exists. |

404 |

Not Found |

E0129 |

Sub merchant name is required for payment facilitators and marketplaces. |

422 |

Unprocessable Entity |

E01290 |

User registration is required to process transaction. You need to use userId instead of plain sender data |

422 |

Unprocessable Entity |

E0132 |

Terminal not exists. |

404 |

Not Found |

E0136 |

Merchant not exists. |

404 |

Not Found |

E0137 |

Default terminal not exist |

422 |

Unprocessable Entity |

E0150 |

Transaction rejected |

422 |

Unprocessable Entity |

E0151 |

Transaction rejected, currency not supported |

422 |

Unprocessable Entity |

E0152 |

Transaction rejected, issuer card not supported |

422 |

Unprocessable Entity |

E0153 |

Transaction declined, problem with MIP connection |

500 |

Internal Server Error |

E0154 |

Failed to fetch transaction details |

500 |

Internal Server Error |

E0155 |

Transaction not exist |

404 |

Not Found |

E0156 |

Transaction rejected, terminal not supported 3ds |

422 |

Unprocessable Entity |

E0157 |

Transaction rejected, card not supported 3ds |

422 |

Unprocessable Entity |

E0158 |

Transaction rejected, maximum transaction amount limit exceeded |

422 |

Unprocessable Entity |

E0159 |

Transaction rejected, restricted transaction amount has occurred |

422 |

Unprocessable Entity |

E01580 |

Transaction rejected. Card is expired. |

422 |

Unprocessable Entity |

E01581 |

Transaction rejected. Not found Card Authentication (3DS 2.X) |

422 |

Unprocessable Entity |

E01582 |

Transaction rejected. Card Authentication not match to transaction type (3DS 2.X) |

422 |

Unprocessable Entity |

E01583 |

Transaction rejected. Outside 3ds is required for terminal |

422 |

Unprocessable Entity |

E01584 |

Transaction rejected, 3DS 2.X flow invoked for other card number than specified in the request |

422 |

Unprocessable Entity |

E01585 |

Transaction rejected, Outside 3ds values are not valid for Card Authentication. |

422 |

Unprocessable Entity |

E01586 |

Transaction rejected, data from transaction request does not match to Card Authentication data. |

422 |

Unprocessable Entity |

E01587 |

Transaction rejected, business card not supported |

422 |

Unprocessable Entity |

E01590 |

Transaction rejected, cof card not found in db |

422 |

Unprocessable Entity |

E01591 |

Transaction rejected, initial cof transaction not approved |

422 |

Unprocessable Entity |

E01592 |

Transaction rejected, recurring card not found in db |

422 |

Unprocessable Entity |

E01593 |

Transaction rejected, initial recurring transaction not cleared |

422 |

Unprocessable Entity |

E01594 |

Transaction rejected, transactionXId parameter had registered for another transaction |

422 |

Unprocessable Entity |

E01596 |

Transaction rejected, terminal blocks transactions with card issued in given card country |

422 |

Unprocessable Entity |

E01598 |

Transaction rejected, ECI value is not available for card provider |

422 |

Unprocessable Entity |

E01599 |

Transaction declined, processing timeout |

500 |

Internal Server Error |

E01600 |

Transaction rejected, 3DS 2.X flow invoked for other card number than specified in the request |

422 |

Unprocessable Entity |

E01601 |

Transaction rejected, terminal is blocked for provider |

422 |

Unprocessable Entity |

E01602 |

Transaction rejected, geographic scope is not permitted for this transaction |

422 |

Unprocessable Entity |

E01603 |

Transaction rejected, Transactions without 3ds above 30 EUR (the blockade applies only to EU countries) |

423 |

Locked |

E01604 |

Transaction rejected, transactions 3DS 1.X not supported for given country |

422 |

Unprocessable Entity |

E01605 |

Transaction rejected, minimum transaction amount not reached |

422 |

Unprocessable Entity |

E01606 |

Transaction rejected, country of residence is not permitted |

422 |

Unprocessable Entity |

E01607 |

Transaction rejected, internal server error during authorization request generation |

422 |

Unprocessable Entity |

E01608 |

Error validation |

422 |

Unprocessable Entity |

E01609 |

Calculated commission for given UUID is expired or does not exists |

422 |

Unprocessable Entity |

E01610 |

Calculated commission has other values than transaction |

422 |

Unprocessable Entity |

E01611 |

Amount is to small |

422 |

Unprocessable Entity |

E01612 |

Mastercard mac tpe excellence rule |

422 |

Unprocessable Entity |

E01613 |

Error sender country is required for merchant crypto |

422 |

Unprocessable Entity |

E01614 |

Receiver country of residence is required for merchant crypto |

422 |

Unprocessable Entity |

E01615 |

Merchant crypto outside eea uk not supported |

422 |

Unprocessable Entity |

E01616 |

Error phone already exists |

422 |

Unprocessable Entity |

E01617 |

Card with phone number already exists |

422 |

Unprocessable Entity |

E01618 |

Error not authorized |

422 |

Unprocessable Entity |

E01619 |

API token not found |

422 |

Unprocessable Entity |

E01620 |

Error 3DS failed |

422 |

Unprocessable Entity |

E01621 |

Required data not complete |

422 |

Unprocessable Entity |

E01622 |

3DS 2.X flow invoked for other merchant |

422 |

Unprocessable Entity |

E01623 |

Sender card is blocked |

422 |

Unprocessable Entity |

E01624 |

Receiver card is blocked |

422 |

Unprocessable Entity |

E01625 |

Sender user is blocked |

422 |

Unprocessable Entity |

E01626 |

Receiver user is blocked |

422 |

Unprocessable Entity |

E01627 |

Sender bin is blocked |

422 |

Unprocessable Entity |

E01628 |

Receiver bin is blocked |

422 |

Unprocessable Entity |

E01631 |

Funding bank is blocked |

422 |

Unprocessable Entity |

E01632 |

Payment bank is blocked |

422 |

Unprocessable Entity |

E01633 |

Possible soft decline alert |

422 |

Unprocessable Entity |

E01634 |

Error user verification |

422 |

Unprocessable Entity |

E01635 |

Error mail verification |

422 |

Unprocessable Entity |

E01636 |

Error merchant or card country same as receiver bank not permitted |

422 |

Unprocessable Entity |

E01637 |

Error sender country is required for account transfers |

422 |

Unprocessable Entity |

E01638 |

Error sender personalId is required for account transfers |

422 |

Unprocessable Entity |

E01639 |

Transaction rejected, terminal blocks transactions with specified country |

422 |

Unprocessable Entity |

E01640 |

Transaction rejected, terminal does not support blik |

422 |

Unprocessable Entity |

E01641 |

Error receiver bank or card country are not permitted |

422 |

Unprocessable Entity |

E01642 |

Error receiver amount is mandatory for terminal |

422 |

Unprocessable Entity |

E01643 |

Error domestic transaction not permitted for card |

422 |

Unprocessable Entity |

E01644 |

Another transaction with the same id has already been processed. |

422 |

Unprocessable Entity |

E01645 |

Transaction with eci = 07. 3ds is required to finish transaction. |

422 |

Unprocessable Entity |

E01646 |

Transaction rejected, transaction reason is required |

422 |

Unprocessable Entity |

E01647 |

Transaction rejected, suspicious receiver name. |

422 |

Unprocessable Entity |

E01648 |

Sender card is blocked due to confirmed fraud |

422 |

Unprocessable Entity |

E01649 |

Receiver card is blocked due to confirmed fraud |

422 |

Unprocessable Entity |

E01650 |

Transaction rejected. Token expired. |

422 |

Unprocessable Entity |

E01651 |

Transaction rejected. Foreign retailer indicator is required for marketplaces. |

422 |

Unprocessable Entity |

E01652 |

'X-USER-ID' header not found |

422 |

Unprocessable Entity |

E01653 |

Error Contractor country same as receiver bank country not permitted |

422 |

Unprocessable Entity |

E01654 |

Transaction cannot be proceed with chosen funding type terminal. |

422 |

Unprocessable Entity |

E0160 |

Reversal of the payment is processing |

422 |

Unprocessable Entity |

E0161 |

Can’t reversal payment |

422 |

Unprocessable Entity |

E0162 |

Payment is already reversed |

422 |

Unprocessable Entity |

E0163 |

Payment is already refunded |

422 |

Unprocessable Entity |

E0164 |

Reversal rejected. Attempts to refund was made. |

422 |

Unprocessable Entity |

E0165 |

Reversal for transaction exists. |

409 |

Conflict |

E0166 |

Reversal rejected. The time for making the reversal has expired. |

422 |

Unprocessable Entity |

E0167 |

Reversal rejected. Reversal amount exceed transaction amount. |

422 |

Unprocessable Entity |

E0170 |

Clearing of the payment is processing |

422 |

Unprocessable Entity |

E0171 |

Can’t clear payment |

422 |

Unprocessable Entity |

E0172 |

Can’t clear payment, the time is over |

422 |

Unprocessable Entity |

E0173 |

Payment is automatically cleared |

422 |

Unprocessable Entity |

E0174 |

Payment is already cleared |

422 |

Unprocessable Entity |

E0175 |

Can’t clear payment, clearing amount is to low |

422 |

Unprocessable Entity |

E0176 |

Can’t clear payment, clearing amount is to high |

422 |

Unprocessable Entity |

E0177 |

Can’t clear payment, transaction processed by PaymentHub API |

422 |

Unprocessable Entity |

E0180 |

Refund rejected, no MC/VISA response |

500 |

Internal Server Error |

E0181 |

Refund rejected by MC/VISA |

500 |

Internal Server Error |

E0182 |

Refund transaction amount to low |

400 |

Bad Request |

E0183 |

Refund transaction amount to high |

400 |

Bad Request |

E0184 |

Transaction is refunded |

422 |

Unprocessable Entity |

E0185 |

Transaction not cleared, can’t refund |

422 |

Unprocessable Entity |

E0186 |

Refund is already processing |

422 |

Unprocessable Entity |

E0187 |

Transaction is chargeback reported |

422 |

Unprocessable Entity |

E0188 |

Refund rejected. Merchant is not active |

500 |

Internal Server Error |

E0189 |

Refund rejected. Transaction was not approved |

422 |

Unprocessable Entity |

E00180 |

Refund rejected. The time for making the return has expired |

422 |

Unprocessable Entity |

E00182 |

Invalid refund type |

400 |

Bad Request |

E00183 |

Can’t refund payment, transaction processed by PaymentHub API |

422 |

Unprocessable Entity |

E0190 |

Failed to get currency rates |

500 |

Internal Server Error |

E0200 |

Transaction rejected, card is blocked |

422 |

Unprocessable Entity |

E0201 |

Transaction rejected, bin is blocked |

422 |

Unprocessable Entity |

E0202 |

Transaction rejected, terminal is blocked |

422 |

Unprocessable Entity |

E0203 |

Transaction rejected, token is blocked |

422 |

Unprocessable Entity |

E0204 |

Transaction rejected, user is on aml list |

422 |

Unprocessable Entity |

E0205 |

Transaction rejected, bank is blocked |

422 |

Unprocessable Entity |

E0207 |

Transaction rejected, too many attempts declined and card is blocked |

422 |

Unprocessable Entity |

E0208 |

Transaction rejected, second transaction with merchant advice code 03 or 21 within 30 days |

422 |

Unprocessable Entity |

E0209 |

Transaction rejected, sender name contains fraudulent phrase. |

422 |

Unprocessable Entity |

E0210 |

Transaction rejected, suspicious sender name. |

422 |

Unprocessable Entity |

E0211 |

Transaction rejected, card country restricted. |

422 |

Unprocessable Entity |

E0212 |

Sender card country restricted |

422 |

Unprocessable Entity |

E0213 |

Receiver card country restricted |

422 |

Unprocessable Entity |

E0214 |

Transaction rejected, card reached 35 declines within 30 days. |

422 |

Unprocessable Entity |

E0215 |

Transaction rejected, missing complete address for transaction above 15 000 EUR |

422 |

Unprocessable Entity |

E0216 |

Transaction rejected, card is blocked due to confirmed fraud |

422 |

Unprocessable Entity |

E0217 |

Transaction rejected, same card different name and surname. |

422 |

Unprocessable Entity |

E0218 |

Transaction rejected, URL is blocked. |

422 |

Unprocessable Entity |

E0219 |

Transaction rejected. IP address is blocked. |

422 |

Unprocessable Entity |

E0220 |

Transaction rejected, card reached 20 declines within 30 days. |

422 |

Unprocessable Entity |

E0300 |

Error mpi V2 - failed internal |

500 |

Internal Server Error |

E0301 |

Three DS Method Data mismatch |

422 |

Unprocessable Entity |

E0302 |

Error on parsing Three DS Method Data |

422 |

Unprocessable Entity |

E0303 |

Card number not Enrolled in 3DS v2 |

422 |

Unprocessable Entity |

E0304 |

Invalid card authentication id |

422 |

Unprocessable Entity |

E0305 |

Issuer card is not supported |

422 |

Unprocessable Entity |

E0306 |

Invalid card number |

422 |

Unprocessable Entity |

E0307 |

Card Authentication not found |

404 |

Not Found |

E0309 |

Protocol version is not supported |

422 |

Unprocessable Entity |

E0310 |

Invalid Three DS Method Data |

422 |

Unprocessable Entity |

E0311 |

3DS required |

422 |

Unprocessable Entity |

E0400 |

Failed to get currency for card |

500 |

Internal Server Error |

E0401 |

Issuer card is not supported |

422 |

Unprocessable Entity |

E0402 |

Sender card is not supported |

422 |

Unprocessable Entity |

E0403 |

Receiver card is not supported |

422 |

Unprocessable Entity |

E0404 |

Receiver credit card is not supported |

422 |

Unprocessable Entity |

E05000 |

Installment Payment initial not found |

500 |

Internal Server Error |

E05001 |

Installment Payment already confirmed |

500 |

Internal Server Error |

E05002 |

Installment Payment already cancelled |

500 |

Internal Server Error |

E05003 |

Installment Payment already pay in full |

500 |

Internal Server Error |

E05004 |

Installment Payment not confirmed in required time |

500 |

Internal Server Error |

E05005 |

Installment Payment Initial was failed |

500 |

Internal Server Error |

E05006 |

Installment Payment could not find valid installment plan for requested uuid |

500 |

Internal Server Error |

E05007 |

Installment Payment Option not allowed for transaction |

500 |

Internal Server Error |

E05008 |

Installment Payment missing plan uuid |

500 |

Internal Server Error |

E05009 |

Installment Payment missing request number of installments |

500 |

Internal Server Error |

E05010 |

Installment Payment requested number of installments is outside of allowed range |

500 |

Internal Server Error |

E05011 |

Installment Payment operation not allowed, installment type allows ISSUER_FINANCED installments |

500 |

Internal Server Error |

E05012 |

Installment Payment reverse not allowed |

500 |

Internal Server Error |

E05013 |

Installment Payment refund not allowed |

500 |

Internal Server Error |

E05014 |

Installment Payment outside 3ds request is required for terminal |

500 |

Internal Server Error |

E05015 |

Installment Payment unsupported card provider VISA |

500 |

Internal Server Error |

E06003 |

Datacenter card not found |

404 |

Not Found |

E06004 |

Delete of ecommerce card failed, card not found |

422 |

Unprocessable Entity |

E06005 |

Update of ecommerce card failed, card not found |

422 |

Unprocessable Entity |

E06007 |

Exception occurred while trying to add ecommerce card |

422 |

Unprocessable Entity |

E7001 |

Request id is exploited |

400 |

Bad Request |

E7002 |

Service not available |

503 |

Service Unavailable |

E8000 |

Bad Request |

400 |

Bad Request |

E8001 |

Forbidden |

403 |

Forbidden |

E8012 |

Not found |

404 |

Not Found |

E8002 |

Unauthorized |

401 |

Unauthorized |

E8003 |

Scale of amount is different than the scale of currency |

422 |

Unprocessable Entity |

E8004 |

Some operation for this requestUuid is processing |

422 |

Unprocessable Entity |

E8009 |

Merchant RSA keys not found |

404 |

Not Found |

E8010 |

Merchant RSA key expired |

422 |

Unprocessable Entity |

E8011 |

Internal error during card decrypting |

500 |

Internal Server Error |

E9000 |

Domain error |

500 |

Internal Server Error |

E9001 |

Error acquirer connection |

503 |

Service Unavailable |

E9002 |

Error mpi connection |

503 |

Service Unavailable |

E9003 |

Error monitoring connection |

503 |

Service Unavailable |

E9010 |

Error data center connection |

503 |

Service Unavailable |

E9800 |

Error blik connection. |

503 |

Service Unavailable |

E9011 |

Error limit connection |

503 |

Service Unavailable |

E9012 |

Error mms connection |

503 |

Service Unavailable |

E10000 |

Transaction rejected, terminal daily card transaction limit exceeded |

422 |

Unprocessable Entity |

E10001 |

Transaction rejected, terminal daily transaction limit exceeded |

422 |

Unprocessable Entity |

E10002 |

Transaction rejected, terminal monthly transaction limit exceeded |

422 |

Unprocessable Entity |

E10003 |

Transaction rejected, limit exceeded |

422 |

Unprocessable Entity |

E10004 |

Transaction rejected, contractor daily transaction limit exceeded for Mastercard provider |

422 |

Unprocessable Entity |

E10005 |

Transaction rejected, contractor monthly transaction limit exceeded for Mastercard provider |

422 |

Unprocessable Entity |

E10006 |

Transaction rejected, contractor daily transaction limit exceeded for Visa provider |

422 |

Unprocessable Entity |

E10007 |

Transaction rejected, contractor monthly transaction limit exceeded for Visa provider |

422 |

Unprocessable Entity |

E10008 |

Transaction rejected, contractor daily transaction limit exceeded |

422 |

Unprocessable Entity |

E10009 |

Transaction rejected, contractor monthly transaction limit exceeded |

422 |

Unprocessable Entity |

E10010 |

Error single transaction limit |

422 |

Unprocessable Entity |

E10011 |

Error daily transaction limit |

422 |

Unprocessable Entity |

E10012 |

Error weekly transaction limit |

422 |

Unprocessable Entity |

E10013 |

Error daily count transaction limit |

422 |

Unprocessable Entity |

E10014 |

Error monthly transaction limit |

422 |

Unprocessable Entity |

E10015 |

Error monthly count transaction limit |

422 |

Unprocessable Entity |

E10016 |

Error daily cumulative limit |

422 |

Unprocessable Entity |

E10017 |

Error monthly cumulative limit |

422 |

Unprocessable Entity |

E10018 |

Error merchant mastercard daily cumulative limit |

422 |

Unprocessable Entity |

E10019 |

Error merchant mastercard monthly cumulative limit |

422 |

Unprocessable Entity |

E10020 |

Error merchant visa daily cumulative limit |

422 |

Unprocessable Entity |

E10021 |

Error merchant visa monthly cumulative limit |

422 |

Unprocessable Entity |

E10022 |

Error merchant daily cumulative limit |

422 |

Unprocessable Entity |

E10023 |

Error merchant monthly cumulative limit |

422 |

Unprocessable Entity |

E10024 |

Error account transfer corridor transaction limit |

422 |

Unprocessable Entity |

E10025 |

Transaction rejected, contractor daily transaction limit exceeded for Blik provider |

422 |

Unprocessable Entity |

E10026 |

Transaction rejected, contractor monthly transaction limit exceeded for Blik provider |

422 |

Unprocessable Entity |

E10027 |

Transaction rejected, contractor daily transaction limit exceeded for PayByBankAccount provider |

422 |

Unprocessable Entity |

E10028 |

Transaction rejected, contractor monthly transaction limit exceeded for PayByBankAccount provider |

422 |

Unprocessable Entity |

E11000 |

Time for processing exceeded. |

500 |

Internal Server Error |

E12000 |

Error occurred during decrypting the message |

422 |

Unprocessable Entity |

E14000 |

Waiting for receiver timeout |

422 |

Unprocessable Entity |

E14001 |

Error delayed payment not found |

422 |

Unprocessable Entity |

E14002 |

Error delayed payment attempts exceeded |

422 |

Unprocessable Entity |

E14003 |

Error delayed payment receiver not present |

422 |

Unprocessable Entity |

E14004 |

Error delayed payment receiver not specified |

422 |

Unprocessable Entity |

E14005 |

Error delayed payment unexpected exception occurred |

422 |

Unprocessable Entity |

E14006 |

Error delayed payment trx not registered for delayed processing |

422 |

Unprocessable Entity |

E14007 |

Error delayed payment datacenter receiver not found |

422 |

Unprocessable Entity |

E14008 |

Error delayed payment datacenter card not found |

422 |

Unprocessable Entity |

E14009 |

Error delayed payment datacenter adding receiver failed |

422 |

Unprocessable Entity |

E14010 |

Error delayed payment datacenter adding card failed |

422 |

Unprocessable Entity |

E15000 |

Error card unprovisioned |

422 |

Unprocessable Entity |

E15001 |

Error card not eligible |

422 |

Unprocessable Entity |

E15002 |

Error card not allowed |

422 |

Unprocessable Entity |

E15003 |

Error card declined |

422 |

Unprocessable Entity |

E15004 |

Error card service unavailable |

500 |

Internal Server Error |

E15005 |

Error card system error |

500 |

Internal Server Error |

E15006 |

Error token not found |

404 |

Not Found |

E15007 |

Error occurred during token decryption |

422 |

Unprocessable Entity |

E15008 |

Error card verification failed |

422 |

Unprocessable Entity |

E16000 |

Error cannot process account transfer to specified country code of bank |

422 |

Unprocessable Entity |

E16001 |

Error cannot process account transfer because of internal VISA API error |

500 |

Internal Server Error |

E16002 |

Transaction rejected, account is blocked |

422 |

Unprocessable Entity |

E16003 |

Error cannot get specific Route for provided country and currency pair |

400 |

Bad Request |

E16005 |

Transaction rejected, corridor is not active |

422 |

Unprocessable Entity |

E16006 |

Deposit not found |

422 |

Unprocessable Entity |

E16007 |

Amount exceeds merchant’s current deposit |

422 |

Unprocessable Entity |

E16008 |

External API Timeout |

504 |

Gateway Timeout |

E16009 |

Sender with firstName, lastName and receiver with organizationName required |

422 |

Unprocessable Entity |

E16010 |

Sender and receiver with organizationName required |

422 |

Unprocessable Entity |

E16011 |

Sender and receiver with firstName and lastName without organizationName required |

422 |

Unprocessable Entity |

E16012 |

Main purposeOfPayment field is not configured, please contact Fenige support |

422 |

Unprocessable Entity |

E16013 |

Main purposeOfPayment field is configured correctly but not allowed for this corridor, please choose another one |

422 |

Unprocessable Entity |

E16014 |

Chosen purposeOfPayment field is not allowed for this corridor, please choose another one |

422 |

Unprocessable Entity |

E16015 |

Sender with organizationName and receiver with firstName and lastName without organizationName required |

422 |

Unprocessable Entity |

E17000 |

Transaction rejected, unsuccessful transactions score exceeded |

422 |

Unprocessable Entity |

PA_ERROR_001 |

Validation error |

422 |

Unprocessable Entity |

E18000 |

User not exists |

404 |

Not Found |

E18001 |

User already exists |

409 |

Conflict |

E18002 |

Country is blocked |

422 |

Unprocessable Entity |

E18003 |

Card limit reached |

422 |

Unprocessable Entity |

E18004 |

Card modification daily limit reached |

422 |

Unprocessable Entity |

E18005 |

Card with the same phone number already exists |

409 |

Conflict |

E18006 |

Card exists for another user |

409 |

Conflict |

E18007 |

Card already exists |

409 |

Conflict |

E18008 |

Card not exists |

404 |

Not Found |

E18009 |

User account status does not allow this operation |

422 |

Unprocessable Entity |

E18010 |

User created, but KYC verification not possible due to unacceptable risk category |

422 |

Unprocessable Entity |

E18011 |

User cannot be unblocked, because the block was applied by Fenige. For more information, check the block reason status or contact support |

422 |

Unprocessable Entity |

E18012 |

KYC verification not possible due to unacceptable risk category |

422 |

Unprocessable Entity |

E19000 |

Incremental transaction rejected, no MC/VISA response |

500 |

Internal Server Error |

E19001 |

Incremental transaction rejected by MC/VISA |

500 |

Internal Server Error |

E19002 |

Transaction is incremented |

422 |

Unprocessable Entity |

E19003 |

Transaction cleared, can’t incremental |

422 |

Unprocessable Entity |

E19004 |

Incremental transaction rejected. Merchant is not active |

500 |

Internal Server Error |

E19005 |

Incremental transaction rejected. Transaction was not approved |

422 |

Unprocessable Entity |

2.10. High-risk third countries

The list of third-country jurisdictions which have strategic deficiencies in their anti-money laundering and countering the financing of terrorism regimes that pose significant threats to the financial system of the Union (‘high-risk third countries’)

| High-risk third country |

|---|

Afghanistan |

Barbados |

Burkina Faso |

Cameroon |

Democratic Republic of the Congo |

Gibraltar |

Haiti |

Jamaica |

Mali |

Mozambique |

Myanmar |

Nigeria |

Panama |

Philippines |

Senegal |

South Africa |

South Sudan |

Syria |

Tanzania |

Trinidad and Tobago |

Uganda |

United Arab Emirates |

Vanuatu |

Vietnam |

Yemen |

2.11. Purpose codes of transaction

Purpose codes of transaction for apply only to Mastercard transactions.

| Code | Purpose |

|---|---|

|

Family Support |

|

Regular Labor Transfers (expatriates) |

|

Travel & Tourism |

|

Education |

|

Hospitalization & Medical Treatment |

|

Emergency Need |

|

Savings |

|

Gifts |

|

Other |

|

Salary |

2.12. Additional crypto transaction indicators

Specific indicators based on the type of crypto purchased at the time of transaction required by Visa.

| Code | Indicator |

|---|---|

|

Central Bank Digital Currency (CBDC) or Tokenized Deposit : CBDC: Digital currency issued by a central/regulatory bank. Tokenized Deposit: Blockchain-based equivalent of traditional deposits held by licensed financial institutions. |

|

Stablecoin (Fiat-backed) : Digital assets backed by fiat reserves such as cash, government securities, or other liquid assets. |

|

Blockchain Native Token/Coin : Digital currency required for on-chain transactions, excluding CBDC, tokenized deposits, and stablecoins. |

|

Any Other Type of Non-Fiat Currency |

3. Send money

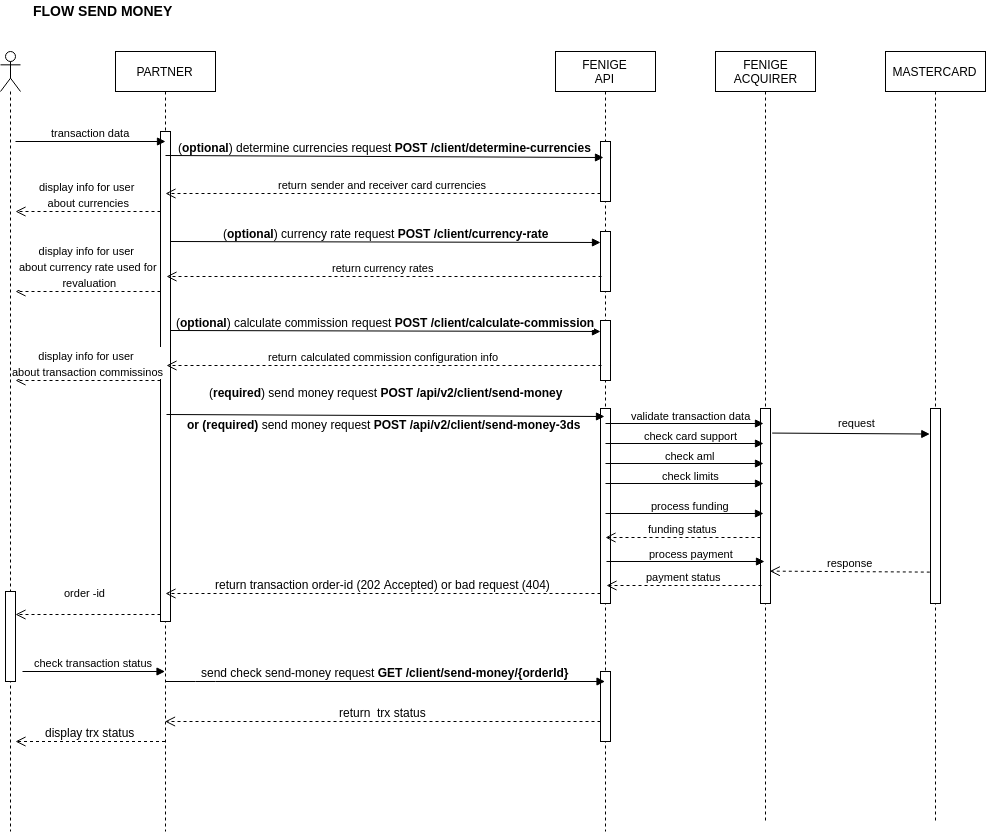

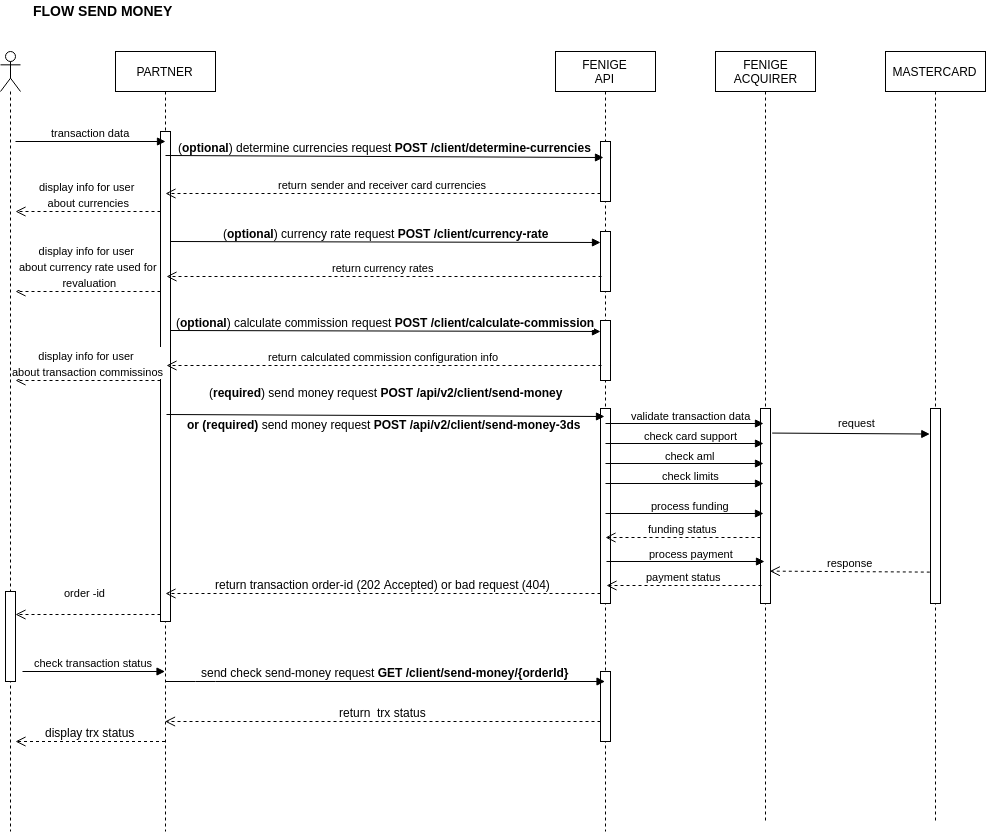

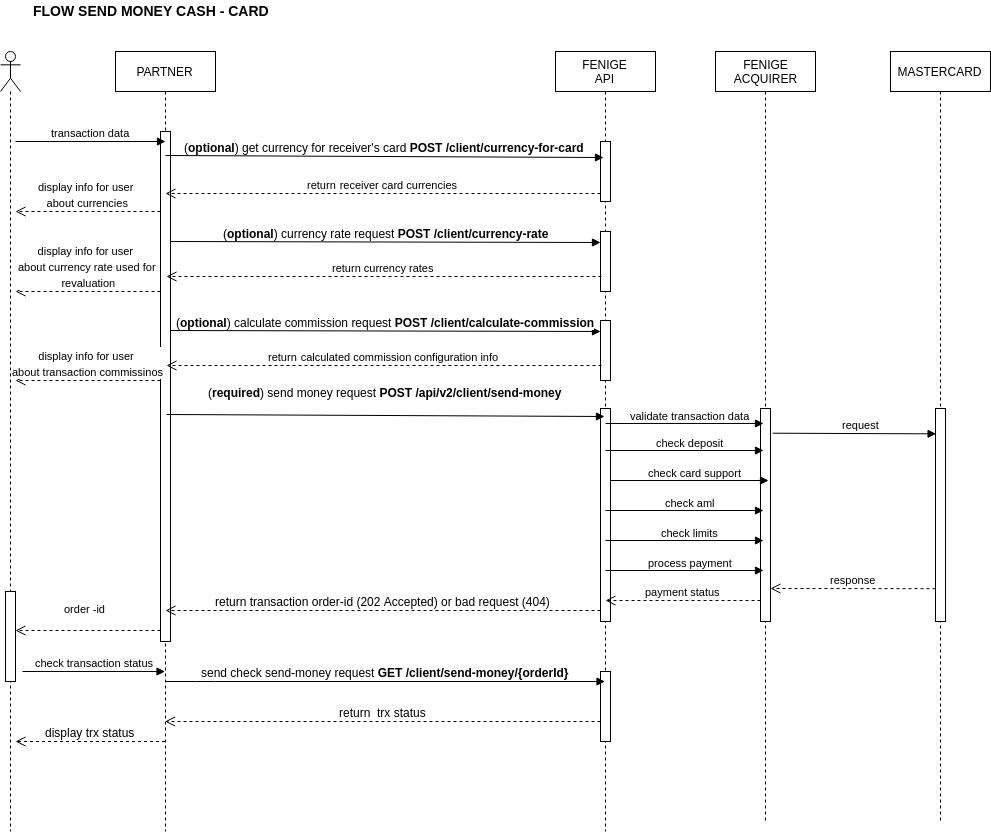

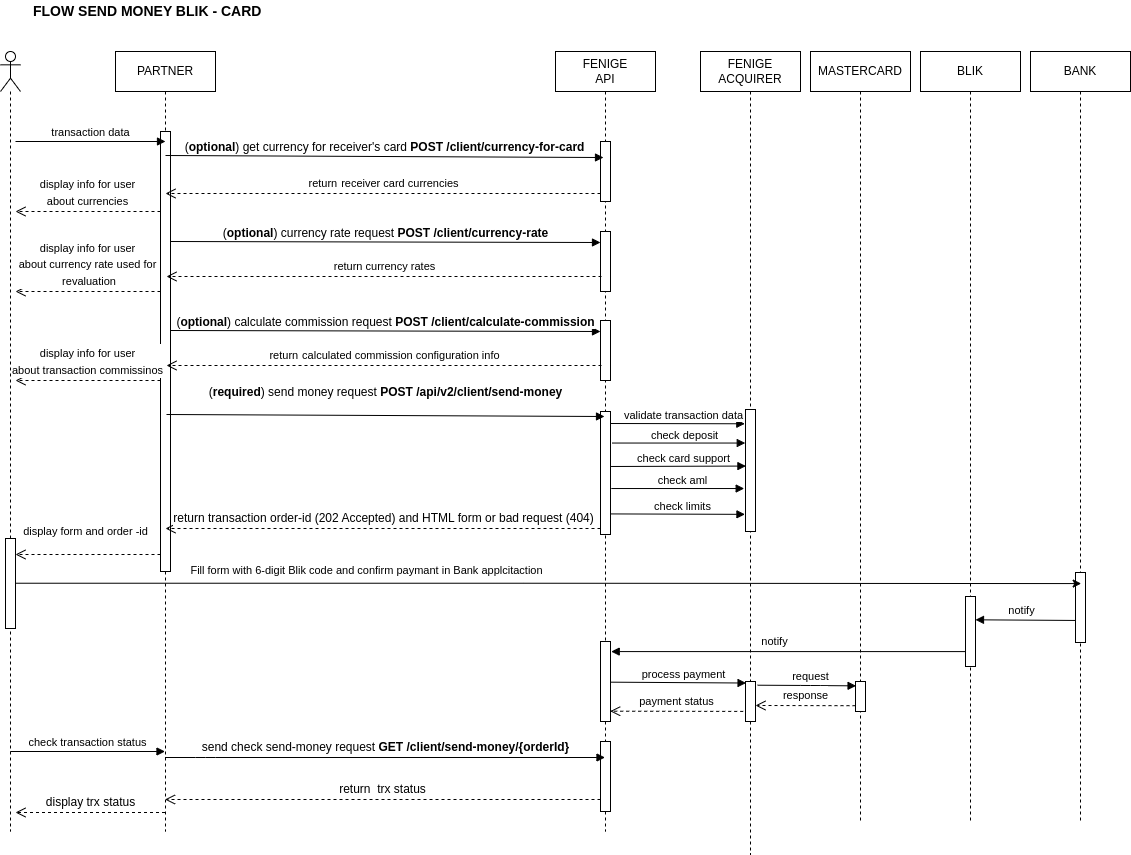

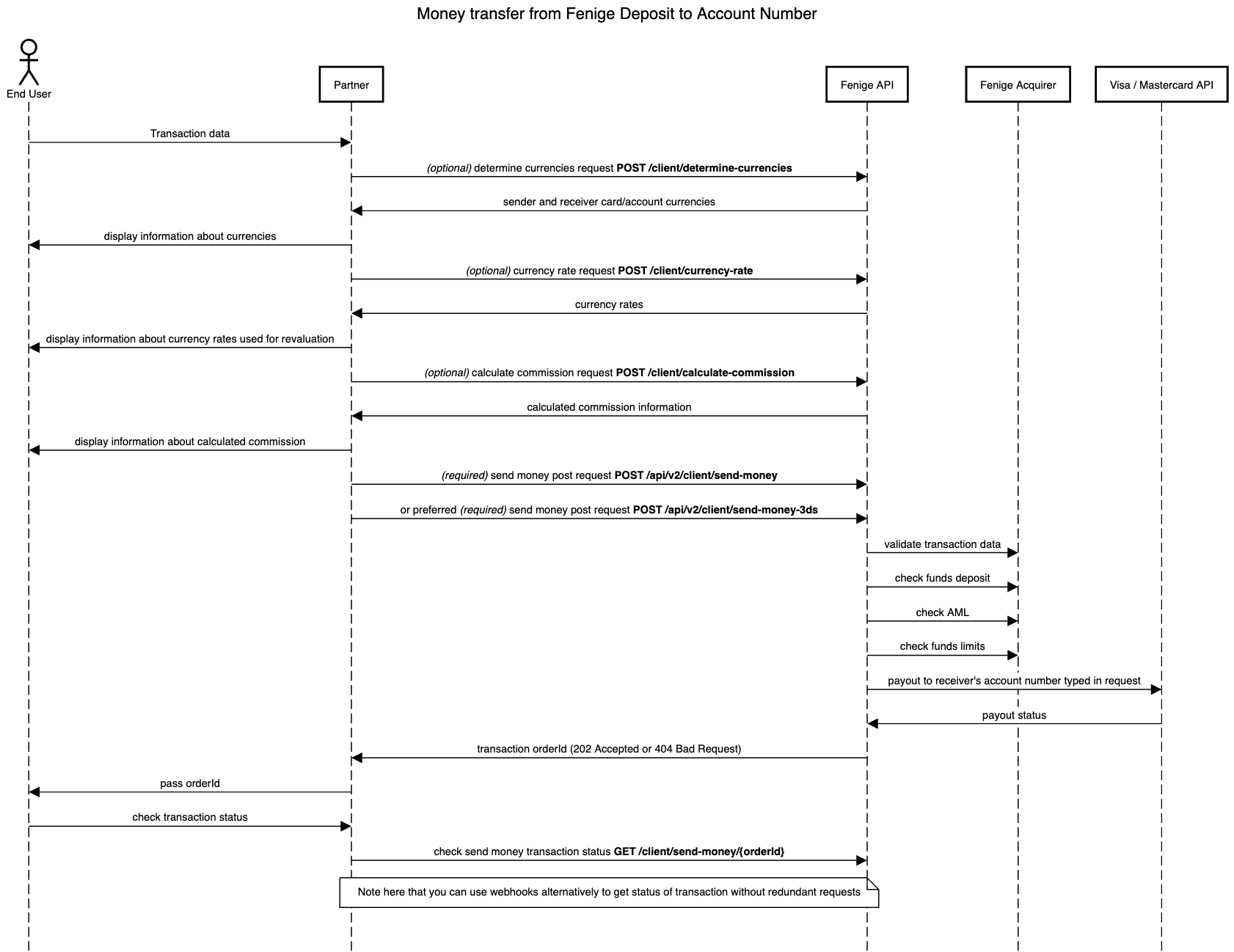

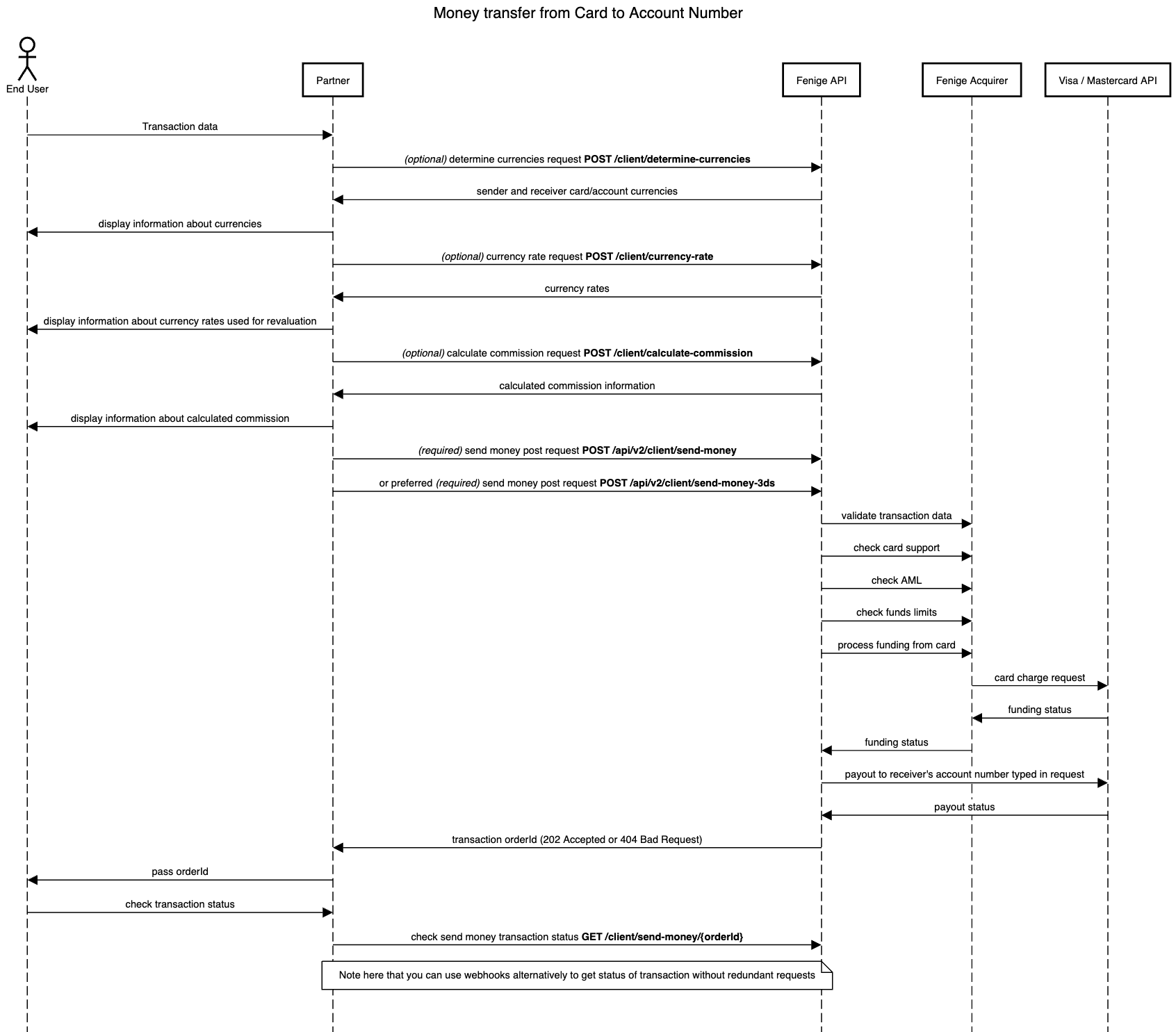

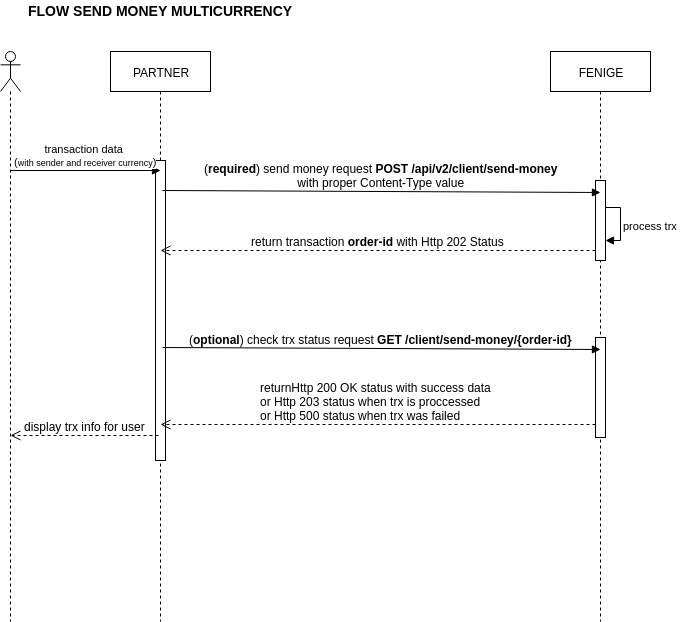

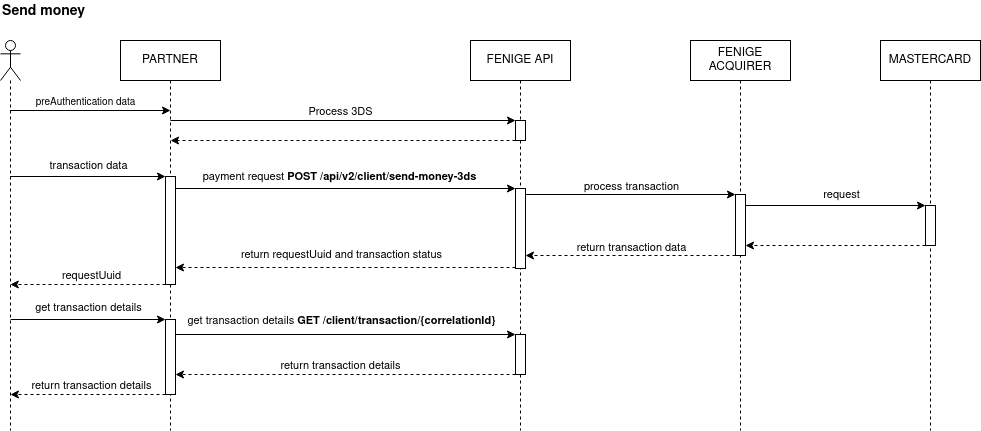

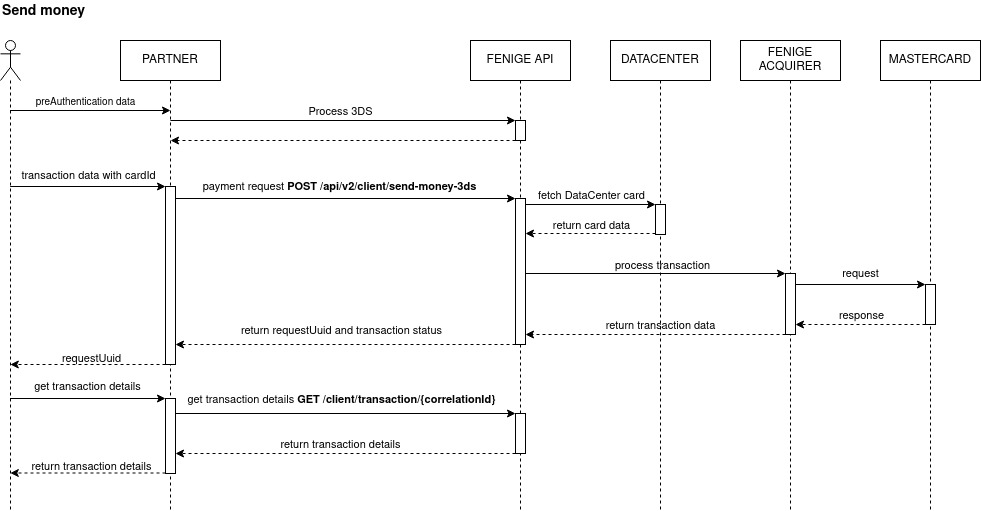

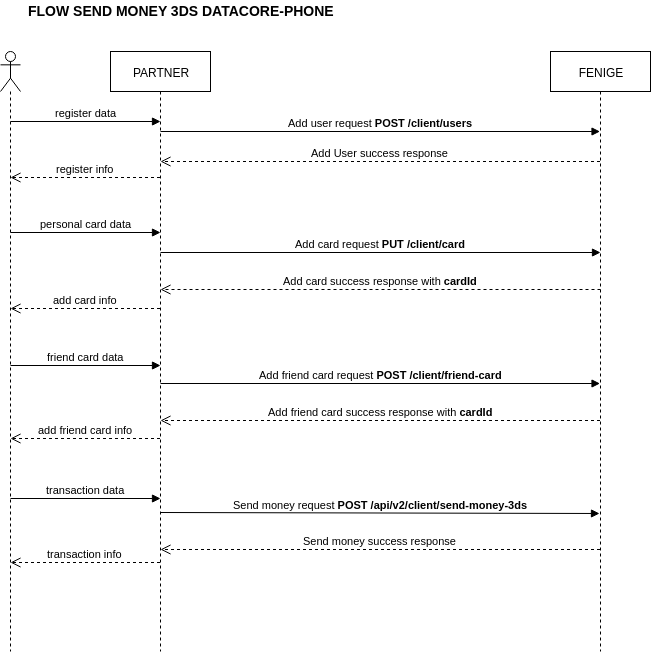

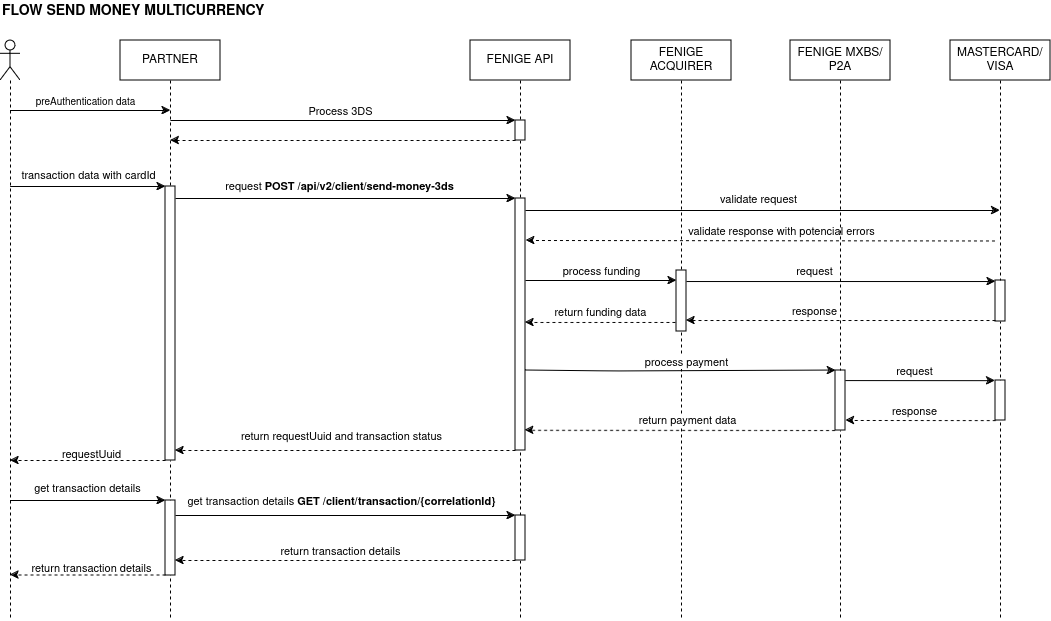

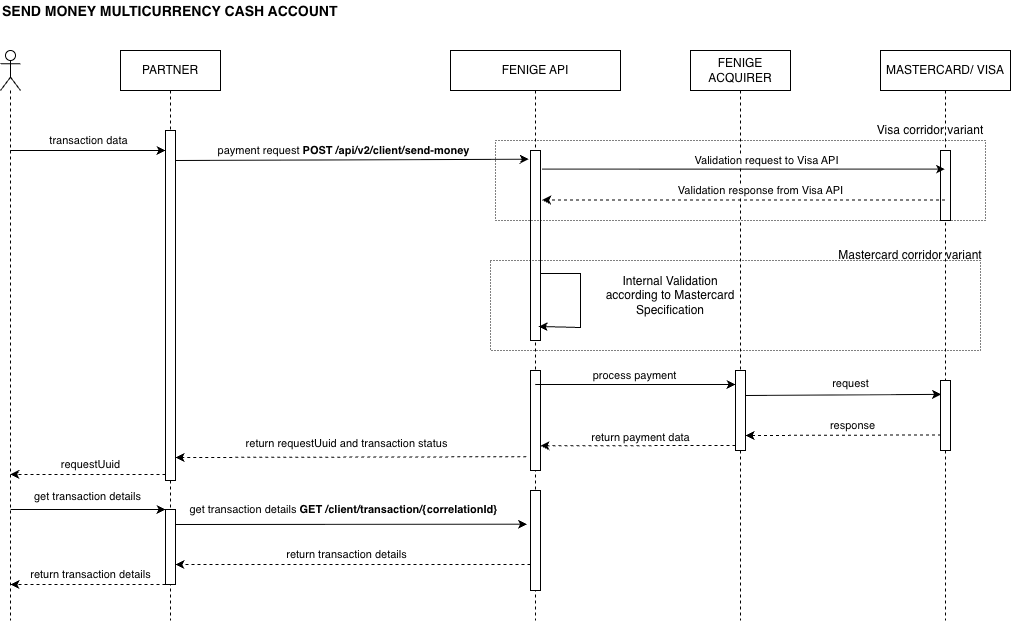

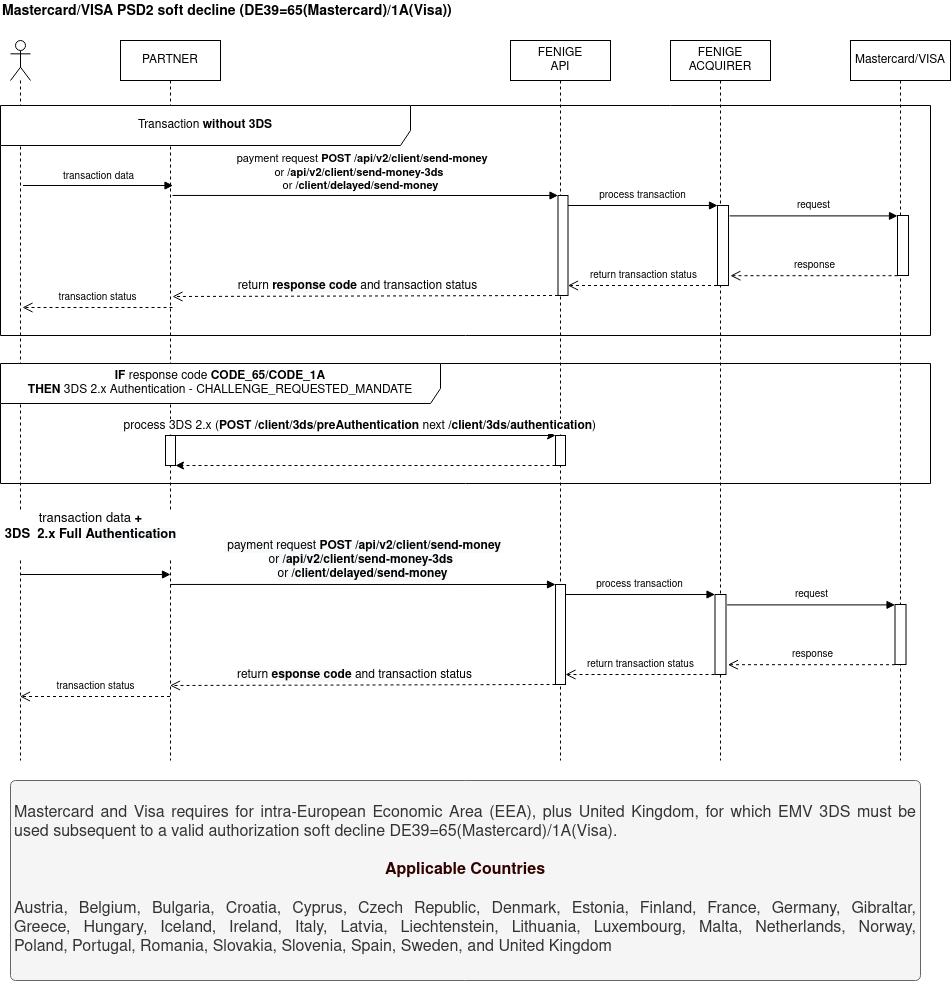

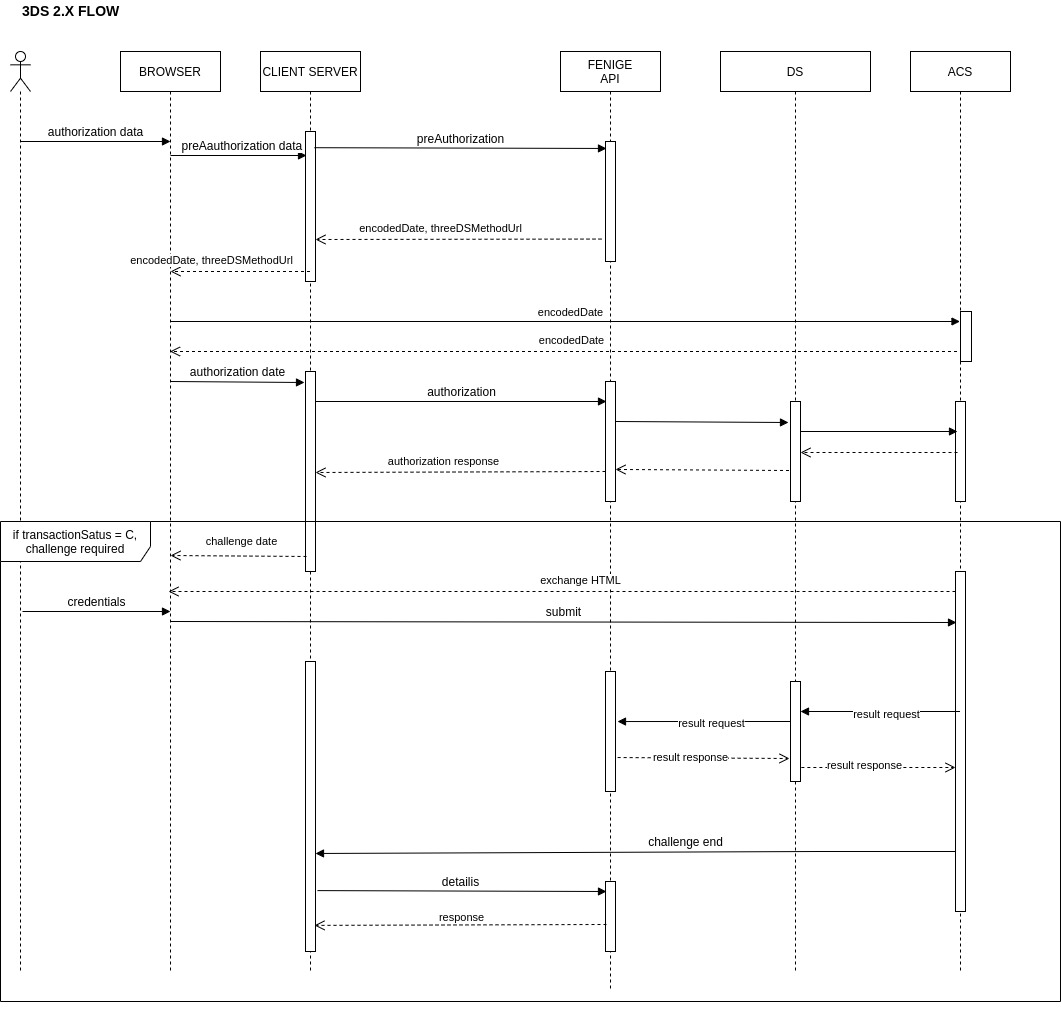

See a diagrams bellow and notice that CARD-CARD and CASH-CARD flow are not the same.

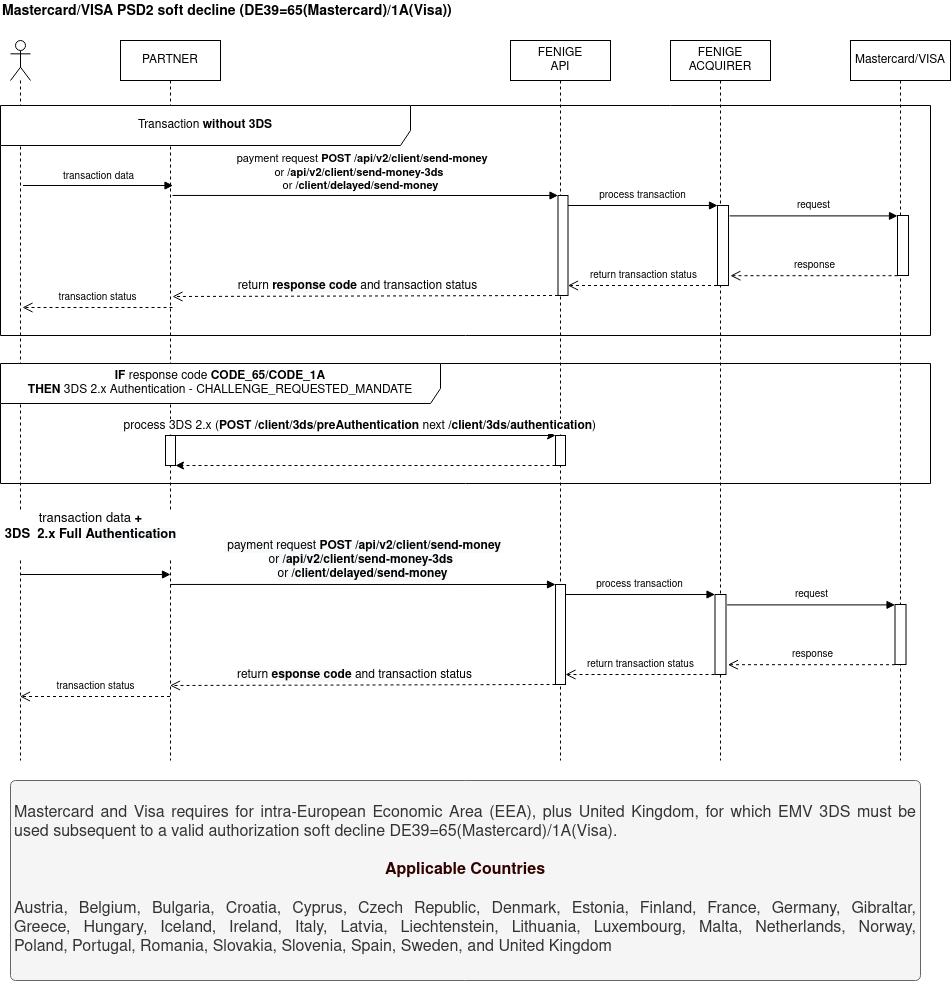

|

Mastercard and Visa requires for intra-European Economic Area (EEA), plus United Kingdom, for which EMV 3DS must be used subsequent to a valid authorization soft decline DE39=65 (Mastercard)/1A(Visa).To perform a transaction for which the card has previously received CODE_65-Mastercard, CODE_1A-VISA, the transaction must be processed with full EMV 3DS (3DS 2.x) and the authentication status must be 'Y'. Correct flow:

|

| In the STAGING environment you can use the test cards available here 2.7. Mock cards for test. |

Is apply for: PLAIN-PLAIN, DATACORE-PLAIN, DATACORE-DATACORE, DATACORE-PHONE

Is apply for: CASH-PLAIN, CASH-PHONE

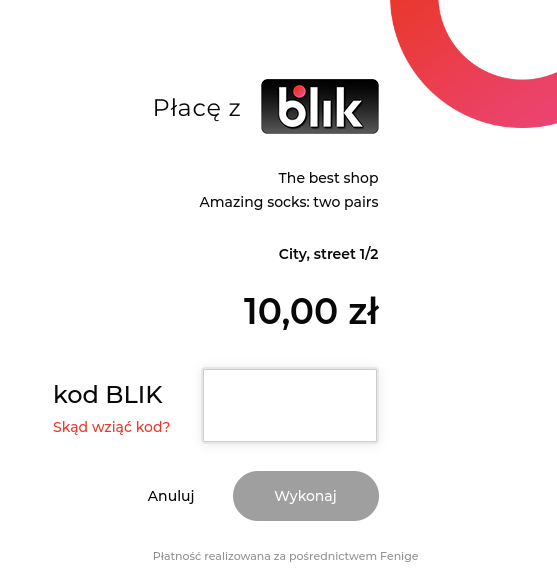

Is apply for: BLIK-PLAIN

Is apply for: CASH-ACCOUNT

Is apply for: PLAIN-ACCOUNT

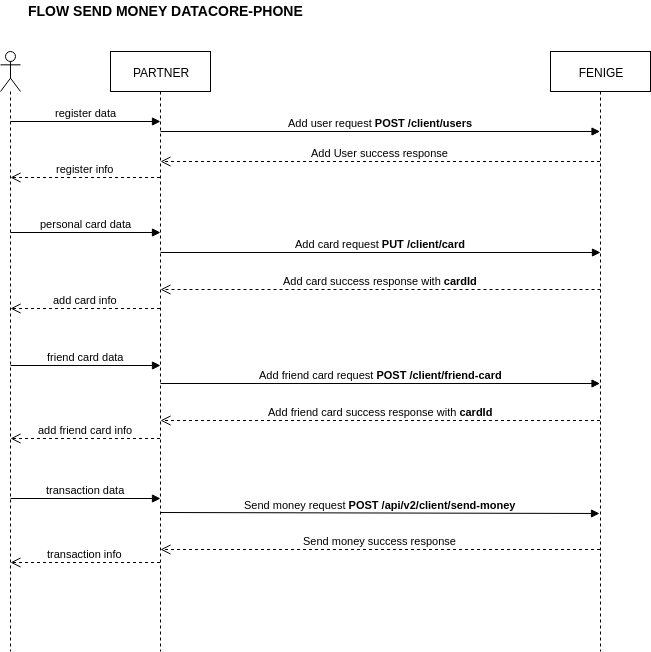

3.1. Card to Card

Innovative technology that allows to send money between cards instantly anywhere in the world. No SWIFT or bank account number needed!

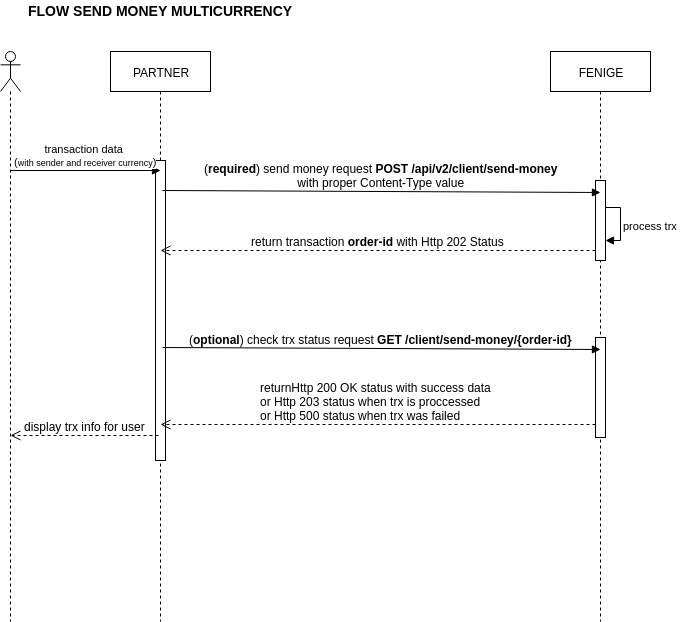

This method is used to MoneySend transaction (funding and payment). To enable users to make transfers in any currency, Fenige introduces the send-money method for multicurrency.

1 - User by selecting type = SENDER defines amount of funding in given currency. This amount is collected from sender card in selected currency. 2 - User by selecting type = RECEIVER defines amount of payment in given currency. This amount is transferred to receiver card in selected currency. In case there's need revaluation from one currency to another, system uses lowerRate for situation 1 and higherRate for situation 2. For more details about specific rates please refer to Currency Rate method.

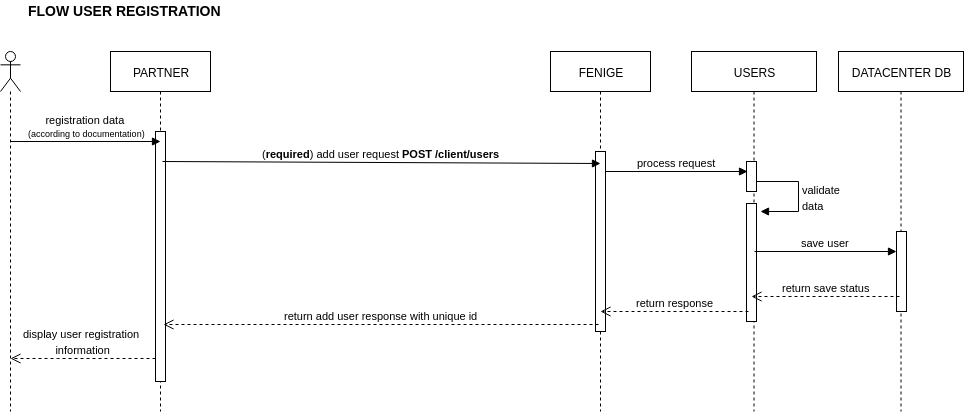

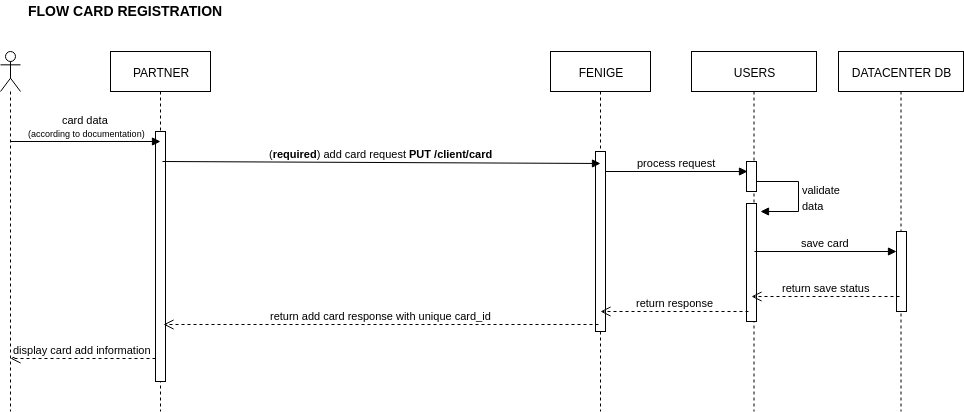

Starting from 2025-05-09, it is possible — and for some clients required — to use the user management methods instead of providing full sender data in the request. This means that when the sender’s information is not included in the request body, the system will rely on a previously registered user identified by userId.

As of July 2025, the API-TOKEN has been replaced with userId and cardId. The userId is a parameter that identifies a user in the database and is obtained by calling the Add User method. The cardId refers to the ID returned when a card is added to the database using the appropriate endpoint. Each card is strictly associated with a specific user, meaning that it is not possible to use a userId together with a cardId that belongs to a different user. Any mismatch between the two will result in a validation error.

| Please notice that you can choose language of email confirmation of this transaction. It is able by attach proper header to request. |

The success of the multicurrency send-money transaction depends primarily on the correctness of the merchant's currency configuration which is done during the creation of your terminals. To make transactions in a currency other than the currency of the card, please contact your account manager.

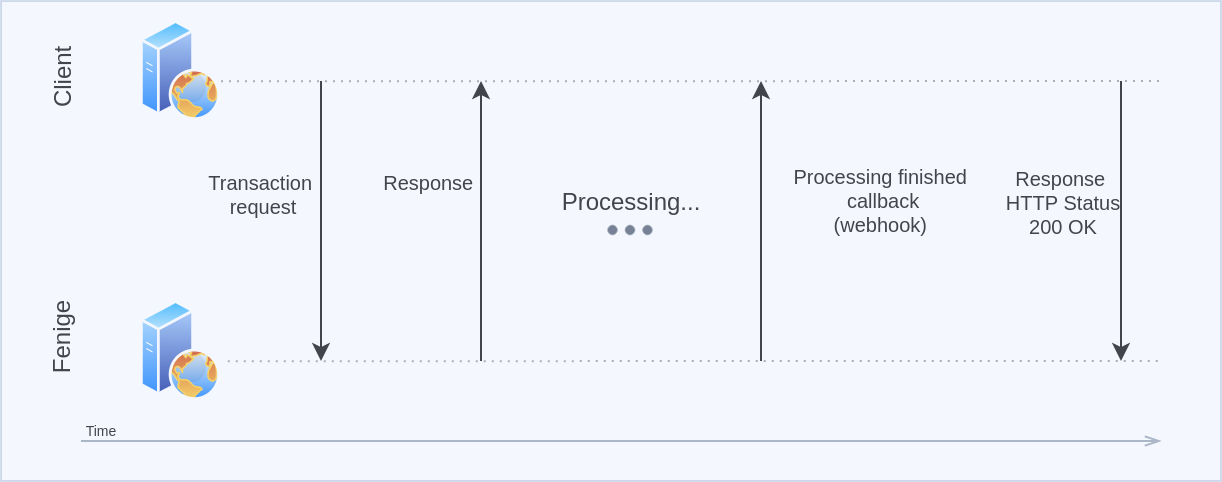

In order to provide users with the ability to safely retry transaction (for example to request for an undelivered response), the v2 of API supports idempotent send money multi-currency operation.

|

From January 2021, there is an internal functionality to restrict access for the Merchant to specific method. The Fenige employee can disable access to a given endpoint, then the HTTP status 403 FORBIDDEN will be returned. The Merchant will be informed about each access restriction action. |

|

When performing authorization, remember that there are currencies with different number of decimal places. For example: VND has no pennies and KWD has three decimal places. Please take this into account in the Amout field. For more information on other currencies, see ISO 4217. |

3.1.1. Request – Full Sender Details

Example HTTP Request – Full Sender Details

POST /client/send-money HTTP/1.1

Content-Type: application/vnd.sendmoney.v2+json

Authorization: Basic bWVyY2hhbnQ6cGFzc3dvcmQ=

Content-Length: 1120

Host: java-staging.fenige.pl:8181

{

"requestId" : "35616bc4-12d4-423b-bb96-9b1d66e97df0",

"transactionId" : "TRX220132AM",

"amount" : 1000,

"cvc2" : "123",

"merchantUrl" : "https://fenige.pl/payments",

"addressIp" : "192.168.0.1",

"type" : "SENDER",

"purposeCodeOfTransaction" : "00",

"sender" : {

"type" : "PLAIN",

"firstName" : "Mark",

"lastName" : "Smith",

"street" : "Olszewskiego",

"houseNumber" : "17A",

"city" : "Lublin",

"postalCode" : "20-400",

"flatNumber" : "2",

"email" : "senderEmail@fenige.pl",

"personalId" : "AGC688910",

"birthDate" : "2026-03-09",

"cardNumber" : "5117964247989169",

"expirationDate" : "03/26",

"currency" : "PLN"

},

"receiver" : {

"type" : "PLAIN",

"firstName" : "Rob",

"lastName" : "Wring",

"cardNumber" : "5117964247989169",

"birthDate" : "2026-03-09",

"countryOfResidence" : "PL",

"currency" : "PLN"

},

"additionalData" : {

"note" : "Restaurant. Tip for Joe Doe"

},

"additionalMerchantCommission" : {

"percent" : 0.8,

"amount" : 0.7

},

"transactionReason" : "Test document transaction"

}Request fields

| Path | Type | Validation | Rule | Description |

|---|---|---|---|---|

amount |

Number |

Required |

@NotNull, positive |

The total transfer amount (in pennies) |

cvc2 |

String |

Required |

@Length(min = 3, max = 3) |

Sender card cvc2/cvv2 |

merchantUrl |

String |

Required |

@NotNull |

Merchant identifier such as the business website URL or reverse domain name as presented to the consumer during checkout |

addressIp |

String |

Required @Must conform to the IPv4 or IPv6 standard. |

@NotNull |

The IP address of the order of transaction. |

type |

String |

Required |

@NotNull |

Determines if the transaction needs to be executed in the 'SENDER' or 'RECEIVER' currency. |

requestId |

String |

Required |

@NotNull |

128 bit number generated by the user, used to identify single transaction. Ensures that the transaction with the given parameter is processed only once. |

transactionId |

String |

Optional |

@Length(max = 64) |

The transactionId field is used for the Merchant to send its own internal transaction identifier. This field is returned in the response from the Check status method and sent by the Webhooks method. |

purposeCodeOfTransaction |

String |

Optional |

The field apply only to Mastercard transactions. Acceptable values: Purpose codes of transaction |

|

transactionReason |

String |

Optional or required for high-risk third countries |

@Pattern(regexp = "^[\\p{L}\\p{N} .,]+$") @Length(min = 1, max = 100) @NotBlank @NotEmpty |

Field used to describe the purpose of the transaction |

sender |

Object |

Required |

@NotNull |

Sender PLAIN Sender TOKEN - PAN_ONLY Sender TOKEN - CRYPTOGRAM_3DS Sender ENCRYPTED_TOKEN Google Sender ENCRYPTED_TOKEN Apple Sender CASH Sender DATACORE |

receiver |

Object |

Required |

@NotNull |

Receiver PLAIN Receiver TOKEN Receiver ENCRYPTED_TOKEN Google Receiver ENCRYPTED_TOKEN Apple Receiver CASH Receiver DATACORE Receiver PHONE |

additionalData.note |

String |

Optional |

@Length(min = 0, max = 150), @Pattern(regexp = |

Note for the transaction |

additionalMerchantCommission |

Object |

Optional |

@Optional |

The commission from the request (supported only for PLAIN_PLAIN or BLIK_PLAIN), if is provided and values is greater then 0 will be added to payer |

additionalMerchantCommission.amount |

Number |

Optional |

@Optional |

The amount commission. It is minimal added commission to the payer |

additionalMerchantCommission.percent |

Number |

Optional |

@Optional |

The percent commission. It is percent value which charge to the payer, if calculated commission is lower then amount commission then amount commission will be apply |

POST /client/send-money HTTP/1.1

Content-Type: application/vnd.sendmoney.v2+json

Authorization: Basic bWVyY2hhbnQ6cGFzc3dvcmQ=

Content-Length: 1224

Host: java-staging.fenige.pl:8181

{

"requestId" : "8aac2265-a345-40b2-b19c-08185e5b888e",

"transactionId" : "TRX220132AM",

"amount" : 1000,

"merchantUrl" : "https://fenige.pl/payments",

"addressIp" : "192.168.0.1",

"type" : "SENDER",

"purposeCodeOfTransaction" : "00",

"sender" : {

"type" : "TOKEN",

"firstName" : "Mark",

"lastName" : "Smith",

"street" : "Olszewskiego",

"houseNumber" : "17A",

"city" : "Lublin",

"postalCode" : "20-400",

"flatNumber" : "2",

"email" : "senderEmail@fenige.pl",

"personalId" : "AGC688910",

"country" : "PL",

"tokenPan" : "5117964247989169",

"tokenType" : "APPLE_PAY",

"expirationDate" : "03/26",

"paymentData" : {

"eciIndicator" : "02",

"onlinePaymentCryptogram" : "/0OL1zEABL+gk70RYJ8lMAABAAA="

},

"currency" : "PLN",

"panOnly" : false

},

"receiver" : {

"type" : "TOKEN",

"firstName" : "Rob",

"lastName" : "Wring",

"email" : "receiverEmail@fenige.pl",

"birthDate" : "2026-03-09",

"countryOfResidence" : "PL",

"currency" : "PLN",

"tokenPan" : "5117964247989169"

},

"additionalData" : {

"note" : "Restaurant. Tip for Joe Doe"

},

"transactionReason" : "Test document transaction"

}Request fields

| Path | Type | Validation | Rule | Description |

|---|---|---|---|---|

amount |

Number |

Required |

@NotNull, positive |

The total transfer amount (in pennies) |

merchantUrl |

String |

Required |

@NotNull |

Merchant identifier such as the business website URL or reverse domain name as presented to the consumer during checkout |

addressIp |

String |

Required @Must conform to the IPv4 or IPv6 standard. |

@NotNull |

The IP address of the order of transaction. |

type |

String |

Required |

@NotNull |

Determines if the transaction needs to be executed in the 'SENDER' or 'RECEIVER' currency. |

requestId |

String |

Required |

@NotNull |

128 bit number generated by the user, used to identify single transaction. Ensures that the transaction with the given parameter is processed only once. |

transactionId |

String |

Optional |

@Length(max = 64) |

The transactionId field is used for the Merchant to send its own internal transaction identifier. This field is returned in the response from the Check status method and sent by the Webhooks method. |

purposeCodeOfTransaction |

String |

Optional |

The field apply only to Mastercard transactions. Acceptable values: Purpose codes of transaction |

|

transactionReason |

String |

Optional or required for high-risk third countries |

@Pattern(regexp = "^[\\p{L}\\p{N} .,]+$") @Length(min = 1, max = 100) @NotBlank @NotEmpty |

Field used to describe the purpose of the transaction |

sender |

Object |

Required |

@NotNull |

Sender PLAIN Sender TOKEN - PAN_ONLY Sender TOKEN - CRYPTOGRAM_3DS Sender ENCRYPTED_TOKEN Google Sender ENCRYPTED_TOKEN Apple Sender CASH Sender DATACORE |

receiver |

Object |

Required |

@NotNull |

Receiver PLAIN Receiver TOKEN Receiver ENCRYPTED_TOKEN Google Receiver ENCRYPTED_TOKEN Apple Receiver CASH Receiver DATACORE Receiver PHONE |

additionalData.note |

String |

Optional |

@Length(min = 0, max = 150), @Pattern(regexp = |

Note for the transaction |

POST /client/send-money HTTP/1.1

Content-Type: application/vnd.sendmoney.v2+json

Authorization: Basic bWVyY2hhbnQ6cGFzc3dvcmQ=

Content-Length: 1132

Host: java-staging.fenige.pl:8181

{

"requestId" : "2dbdbf69-e789-4198-903e-4d98da7a1a5a",

"transactionId" : "TRX220132AM",

"amount" : 1000,

"merchantUrl" : "https://fenige.pl/payments",

"addressIp" : "192.168.0.1",

"type" : "SENDER",

"purposeCodeOfTransaction" : "00",

"sender" : {

"type" : "TOKEN",

"firstName" : "Mark",

"lastName" : "Smith",

"street" : "Olszewskiego",

"houseNumber" : "17A",

"city" : "Lublin",

"postalCode" : "20-400",

"flatNumber" : "2",

"email" : "senderEmail@fenige.pl",

"personalId" : "AGC688910",

"country" : "PL",

"tokenPan" : "5117964247989169",

"tokenType" : "GOOGLE_PAY",

"authMethod" : "PAN_ONLY",

"expirationDate" : "03/26",

"currency" : "PLN",

"panOnly" : true

},

"receiver" : {

"type" : "TOKEN",

"firstName" : "Rob",

"lastName" : "Wring",

"email" : "receiverEmail@fenige.pl",

"birthDate" : "2026-03-09",

"countryOfResidence" : "PL",

"currency" : "PLN",

"tokenPan" : "5117964247989169"

},

"additionalData" : {

"note" : "Restaurant. Tip for Joe Doe"

},

"transactionReason" : "Test document transaction"

}Request fields

| Path | Type | Validation | Rule | Description |

|---|---|---|---|---|

amount |

Number |

Required |

@NotNull, positive |

The total transfer amount (in pennies) |

merchantUrl |

String |

Required |

@NotNull |

Merchant identifier such as the business website URL or reverse domain name as presented to the consumer during checkout |

addressIp |

String |

Required @Must conform to the IPv4 or IPv6 standard. |

@NotNull |

The IP address of the order of transaction. |

type |

String |

Required |

@NotNull |

Determines if the transaction needs to be executed in the 'SENDER' or 'RECEIVER' currency. |

requestId |

String |

Required |

@NotNull |

128 bit number generated by the user, used to identify single transaction. Ensures that the transaction with the given parameter is processed only once. |

transactionId |

String |

Optional |

@Length(max = 64) |

The transactionId field is used for the Merchant to send its own internal transaction identifier. This field is returned in the response from the Check status method and sent by the Webhooks method. |

purposeCodeOfTransaction |

String |

Optional |

The field apply only to Mastercard transactions. Acceptable values: Purpose codes of transaction |

|

transactionReason |

String |

Optional or required for high-risk third countries |